Teach Me! Personal Finance

Our YouTube channel strives to help regular people better understand financial matters as they relate to the federal government, specifically taxes and Social Security.

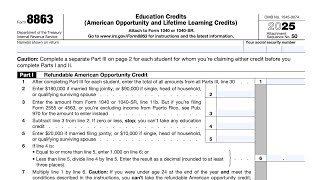

IRS Form 8863 walkthrough (Education Credits)

Пошаговое руководство по форме IRS 14135 (освобождение имущества из-под федерального налогового з...

Пошаговое руководство по форме IRS 2290 (декларация по налогу на использование большегрузных тран...

Как подать жалобу на специалиста по подготовке налоговой отчетности в IRS без подачи формы IRS 14...

Пошаговое руководство по форме IRS 4422 (подача заявления на получение сертификата об освобождени...

Пошаговое руководство по форме IRS 4835 (доходы и расходы от аренды фермы)

Пошаговое руководство по заполнению формы IRS 8453-X (Заявление политической организации для пода...

Разбор формы IRS 6781 (прибыли и убытки по контрактам и стрэддлам по разделу 1256)

Пошаговое руководство по форме IRS 15620 (Раздел 83(b) Выборы)

Обзор формы IRS 6198 (ограничения риска)

Пошаговое руководство по форме IRS 14134 (Заявление на получение сертификата о подчиненности феде...

Пошаговое руководство по форме IRS 211 (Заявление на получение первоначальной информации)

Пошаговое руководство по форме IRS 1045 (Заявление на предварительный возврат)

Пошаговое руководство по форме IRS 8919 (неуплаченный налог на социальное обеспечение и Medicare ...

Форма IRS 8898 (Заявление для лиц, которые начинают или заканчивают добросовестное проживание на ...

Пошаговое руководство по форме IRS 8995 (Квалифицированный вычет дохода для бизнеса — упрощенный ...

Пошаговое руководство по форме IRS 5329 (дополнительные налоги)

Пошаговое руководство по форме IRS 8829 (Расходы на коммерческое использование вашего дома)

Пошаговое руководство по форме IRS 8615 (налог на некоторых детей, имеющих незаработанный доход)

Как понимать уведомление CP231 (IRS необходим обновленный адрес для отправки чека на возврат)

Как отчитаться о номинальных распределениях доходов в виде процентов или дивидендов

Как понимать уведомление CP153 (IRS отправляет вам платеж по кредиту чеком)

Как понимать уведомление CP504B (уведомление IRS о намерении наложить арест (арестовать) активы)

Как понимать ваше уведомление CP515 (данные IRS указывают на то, что вы не подавали форму 1040)

Как понимать уведомление CP508C (IRS сообщило о вашей налоговой задолженности в Государственный д...

Как понимать уведомление CP508R (ваше уведомление о серьезной просроченной задолженности было отм...

Как понимать уведомление CP561C (срок действия ATIN вашего ребенка истек).

Как понимать уведомление CP75D (Ваша налоговая декларация проходит проверку. Налоговому управлени...

Как понять ваше уведомление CP562C (IRS требуется больше информации для одобрения вашего продлени...

Пошаговое руководство по форме IRS SS-16 (Сертификат выбора страхового покрытия)