Teach me finance

(18 of 18) Ch.21 - Summary of Chapter 21

(17 of 18) Ch.21 - Short-run & long-run exchange rate risk exposure

(16 of 18) Ch.21 - Overseas project's Net Present Value calculation using Foreign currency approach

(15 of 18) Ch.21 - Overseas project's Net Present Value calculation using Home currency approach

(14 of 18) Ch.21 - International Fisher effect

(13 of 18) Ch.21 - Uncovered interest parity

(12 of 18) Ch.21 - Unbiased forward rates

(11 of 18) Ch.21 - Interest rate parity: example

(10 of 18) Ch.21 - Interest rate parity: derivation of formula

(9 of 18) Ch.21 - Interest rate parity explained

(8 of 18) Ch.21 - Relative purchasing power parity

(7 of 18) Ch.21 - Absolute purchasing power parity

(6 of 18) Ch.21 - Two types of exchange rate trades

(5 of 18) Ch.21 - Two types of exchange rates

(4 of 18) Ch.21 - Exchange rate explained

(3 of 18) Ch.21 - Eurocurrency, Eurobonds, Foreign bonds, LIBOR, foreign exchange markets

(2 of 18) Ch.21 - Calculation of "cross rate"

(1 of 18) Ch.21 - Chapter overview

(1 of 17) Ch.14 - Big picture of the Chapter

(2 of 17) Ch.14 - Cost of capital: overview

(3 of 17) Ch.14 - Cost of equity: explained

(4 of 17) Ch.14 - Cost of equity: example using "dividend growth model" approach

(5 of 17) Ch.14 - Cost of equity: example using "CAPM" approach

(6 of 17) Ch.14 - Cost of equity: example using both approaches

(7 of 17) Ch.14 - Cost of preferred stock: explanation & example

(8 of 17) Ch.14 - Cost of debt: explanation & example

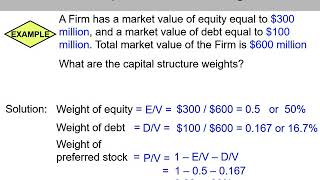

(9 of 17) Ch.14 - Capital structure weights: explained

(10 of 17) Ch.14 - Capital structure weights: 2 examples

(11 of 17) Ch.14 - WACC: building the formula

(12 of 17) Ch.14 - Calculate WACC: example