finRGB

Welcome to the finRGB FRM Exam Prep Channel! This channel is dedicated to helping you excel in the FRM Part 1 and Part 2 exams. For comprehensive study materials (instructional videos, notes, question sets), please visit our website at https://www.finRGB.com. While you're here, make sure you subscribe to this channel to stay updated on high-quality videos designed to simplify complex risk management concepts, provide in-depth explanations, and offer practical tips.

Bhuvnesh Khurana, CFA, FRM

Law of Iterated Expectations | Law of Total Expectation | FRM Part 1 | CFA Level 1

Understanding N(z) Vs N-Inverse(p) Vs N'(z) in Normal Distribution | FRM Part 1

Credit Valuation Adjustment (CVA) for a European Option | FRM Part 2 (Credit Risk) | Solved Example

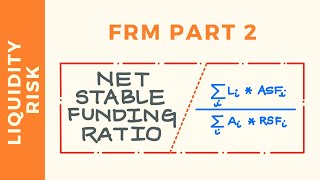

Net Stable Funding Ratio (NSFR) Explained | FRM Part 2 | Liquidity Risk

Credit Value-at-Risk (VaR) | FRM Part 2 | Credit Risk

Positive Definite Correlation Matrices | FRM Part 1 (Quantitative Analysis)

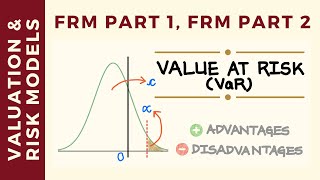

Value at Risk (VaR) - Advantages & Disadvantages Explained | FRM Part 1 / FRM Part 2 | CFA Level 2

Expected Value and Variance of a Discrete Random Variable | FRM Part 1 | Quantitative Analysis

Index Credit Default Swaps Explained | FRM Part 2 | Credit Risk

Volatility Smile and Skew | FRM Part 2 | Market Risk

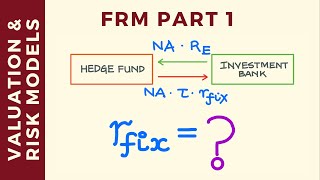

Overnight Index Swaps (OIS) Explained | Mechanics and Use (FRM Part 1)

Study Sequence for FRM Part 2 (2024)

Equity Swaps Explained: Pricing and Valuation | CFA Level 2

Liquidity Coverage Ratio (LCR) Explained | FRM Part 2 | Liquidity Risk | CFA Level 2

Bootstrapping | Bootstrap Resampling in Statistics | CFA Level 1 | FRM Part 1 | FRM Part 2

Non-Deliverable Forwards (NDFs) Explained | CFA Level 3

Equity Swaps Explained: Mechanics and Variations | FRM Part 1 | CFA Level 2

Moving Average (MA) Models | Time Series Analysis | FRM Part 1 | CFA Level 2

Credit Exposure Metrics (EFV, EE, PFE) for Interest Rate Swap | FRM Part 2

SOFR Futures Explained | FRM Part 1

Covered Vs Uncovered Interest Rate Parity | FRM Part 1 | CFA Level 2

Variance Swaps Explained | Mechanics & Use | FRM Part 1 | CFA Level 3

Do I need to be strong at Math to ace the FRM exam? (FRM Part 1, FRM Part 2)

Put Call Forward Parity for European Options (FRM Part 1, CFA Level 1)

Monte Carlo Variance Reduction using Antithetic Variates (FRM Part 1, Quantitative Analysis)

Wrong Way Risk - An Introduction (FRM Part 1 / FRM Part 2, Book 2, Credit Risk)

What does the Autocorrelation vs Lag Plot (Correlogram) tell us? (FRM Part 1, Quantitative Analysis)

Expected Shortfall for Uniform Distribution (Solved Example)(FRM Part 1, Valuation and Risk Models)

Structural Vs Reduced Form Models of Credit Risk (CFA Level 2, FRM Part 2, Book 2, Credit Risk)

10 Tips to Pass FRM Part 2 Exam