UK Property Trusts V Property Family Limited Companies - A Property Expert Panel discussion

Автор: Optimise Accountants (UK Tax)

Загружено: 2020-07-27

Просмотров: 8201

Please watch: "Save Business & Investment Costs & Tax - 28-day trial free trial"

• Save Business & Investment Costs & Tax - 2... -~-

UK Property Trusts V Property Family Limited Companies - A Property Expert Panel discussion

Why not register for next session here: https://bit.ly/2VOKOt9

In this episode we discussed the following topics

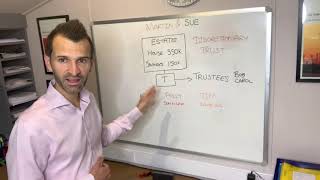

▶ What is a trust?

▶ How can a property be moved from a personal name into a trust?

▶ Is a buy to let property protected within a trust?

▶ How is a property trust taxed by HMRC?

▶ How much tax is paid on the property profits within a trust and can it be claimed back?

▶ Can you get a buy to let mortgage within a property trust?

▶ Why is a trust used over and above a family limited company (FIC)

▶ What are Family Limited Companies (FICs) and how can UK landlords use them to save tax on the buy to let property portfolio.

▶ Tim Bishop explains the legal consideration of a trust

▶ Tim Bishop explains the legal consideration of a Family Limited Company

▶ Simon Hodgson explains how banks and mortgage lenders see property trusts

▶ Simon Hodgson explains how banks and mortgage lenders see property family limited companies FIC

▶ How should you own a property investment?

▶ Is a trust better than a limited company?

▶ Why should UK landlords ensure that there will is up to date

▶ Why should UK buy to let property investors ensure that they have a power of attorney on place?

#PropertyExpertPanel #Property #BuyToLet

On the expert panel we had:

Bronwen Vearncombe - Mentor/Coach - https://bit.ly/3gyympG

Simon Misiewicz - Tax Specialist - https://bit.ly/3f3zhOk

Tim Bishop – Solicitor - https://bit.ly/2ZHp3g9

Jenny Mulholland - Letting agent - https://bit.ly/2Z2MwsX

Simon Hodgson - Mortgage Broker - https://bit.ly/2D8gZ0e

Paul Hilliard - LNPG buyers consortium - https://bit.ly/3fgTiAY

Teresa Kaczmarek - National Landlords Residential Association - https://bit.ly/38TPQtU - Use code 123 to get a discount

Доступные форматы для скачивания:

Скачать видео mp4

-

Информация по загрузке: