Paid Too Much in Taxes This Year? Here's How to Pay Less Next Time

Автор: Sports Card Tax Guy

Загружено: 2025-05-16

Просмотров: 109

Tax season is over, but now what? Whether you’re stressed out over unfiled taxes and IRS notices, feeling like you overpaid, or scaling your business and looking to save more, this video breaks down what to do next. From handling penalties and getting representation, to improving your bookkeeping, tracking mileage, and implementing powerful tax strategies like home office deductions, S Corporation conversions, and retirement plans, this is your guide to reducing tax stress and increasing financial success year-round.

Bookkeeping Systems: • Why Bookkeeping Matters for Your Sports Ca...

Chapters:

00:00 Intro

00:23 Preface

00:31 Types of People Curious on What's Next

00:55 1st Type

01:51 2nd Type

02:47 3rd Type

03:00 Tax Strategies

03:14 Home Office

03:46 Retirement Plan

04:17 Tax Advisor

04:35 Summary

04:47 Outro

🔹 After April 15, individuals fall into three categories: behind on taxes, recently filed but dissatisfied, or scaling and needing proactive tax strategies.

🔹 Those with IRS notices or unfiled returns may need professional help (EA/CPA) to avoid levies and resolve penalties.

🔹 If filing was stressful or you feel you overpaid, improving your bookkeeping and tracking (like using MileIQ for mileage) is a game-changer.

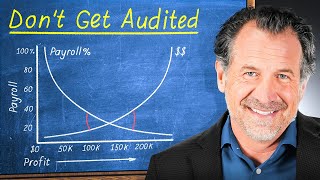

🔹 For those earning $50K–$300K+, basic strategies like the home office deduction, converting to an S corp, or setting up retirement plans can save big.

🔹 Advanced tax strategies—like real estate moves or structured travel meetings with a board—can unlock even more savings when implemented properly.

🔔 Subscribe for more expert tips on sports card taxes, bookkeeping, and business success!

About Sports Card Tax Guy

Welcome to Sports Card Tax Guy, where we help sports card and collectibles entrepreneurs minimize taxes, maximize profits, and grow their business. Whether you're flipping sports cards, running a collectibles business, or just getting started, this channel is your go-to resource for tax strategies, QuickBooks tutorials, and financial tips designed specifically for the hobby world!

💰 What You’ll Learn on This Channel:

✅ How to legally reduce your tax bill

✅ QuickBooks & DIY bookkeeping tips for sports card sellers

✅ Common tax mistakes collectors make (and how to avoid them!)

✅ How to structure your sports card business for success

✅ And much more! (Leave a comment about certain topic and I'll try to create a content about it 😉)

📞 Need Help with Your Taxes?

Schedule a FREE consultation: https://sportscardtaxguy.com/contact-us

📧 Email: [email protected]

📞 Call: 954-882-7522

🏢 Office: Gainesville, FL

🔗 Follow Us for More Tax & Business Tips:

🌐 Website: https://sportscardtaxguy.com/

🔗 LinkedIn: / sports-card-tax-guy

📲 Social Media:

YT: / @sportscardtaxguy

FB: https://www.facebook.com/profile.php?...

IG: / sportscardtaxguy

📢 Don’t miss out—hit the LIKE button & SUBSCRIBE for more videos on sports card taxes, bookkeeping, and financial success!

#AfterTaxSeason #TaxPlanning #IRSHelp #TaxStrategies #entrepreneurfinance #SolePropToSCorp #SEPRetirement #TaxRelief #LateFilingHelp #FinancialSuccess #HomeOfficeDeduction #MileageTracking #TaxSavingTips #BusinessFinance #TaxDeductions #TaxTimeStress #SoleProprietorTips #SmartTaxMoves

Доступные форматы для скачивания:

Скачать видео mp4

-

Информация по загрузке: