Fixed-Income Bond Valuation:Prices - Module 6 – FIXED INCOME– CFA® Level I 2025 (and 2026)

Автор: FinQuiz Pro

Загружено: 2024-10-23

Просмотров: 6809

Get our FREE CFA Level 1 summaries: https://www.finquiz.com/cfa/level-1/s... 💸 Fixed Income = Not Just Bonds. It’s How the Game Works.

Yield curves, duration traps, callable bonds... Fixed Income isn’t boring—it’s the engine room of finance. If you can master this, you’re already ahead. Let FinQuiz walk you through it—minus the confusion.

📚 Battle-Ready Summaries – Z-spreads, convexity, price–yield relationships—made understandable

👉 https://www.finquiz.com/cfa/level-1/s...

📖 Stanley Notes – Deep explanations of bond math, risks, structures, and cash flow logic 🧠

👉 https://www.finquiz.com/cfa/level-1/n...

📐 Formula Sheet – YTM, duration, PV calculations—clean, visual, and test-day ready

👉 https://www.finquiz.com/cfa/level-1/f...

🎯 Question Bank – Practice with real-style bond Qs that challenge your timing and logic

👉 https://www.finquiz.com/cfa/level-1/q...

⏱️ Mock Exams – Simulate full-length exams packed with fixed income tricks and traps

👉 https://www.finquiz.com/cfa/level-1/m...

📦 Full CFA Level 1 Collection

👉 https://www.finquiz.com/cfa/level-1/

🚀 Go Premium – Unlock all tools + get a crystal-clear path through the bond jungle

👉 https://www.finquiz.com/cfa/level-1/p...

Unlock the complexities of bond valuation in Module 6 of our Fixed Income series tailored for CFA® Level I candidates preparing for 2025 exam. This video dives deep into the fundamentals of fixed-income securities, focusing on how bond prices and yields are determined in the financial markets.

What You'll Learn:

Bond Pricing Mechanics: Understand how bonds are priced based on present value calculations and future cash flows.

Interest Rates and Yields: Explore the relationship between interest rates and bond yields, including yield to maturity.

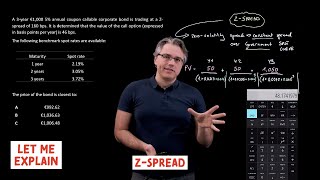

Yield Measures: Learn about different yield measures like current yield, yield to call, and yield to worst.

Price-Yield Relationship: Grasp why bond prices move inversely to interest rate changes.

Discounted Cash Flow Analysis: Apply DCF techniques to evaluate bonds accurately.

Term Structure of Interest Rates: Examine yield curves and their implications for bond valuation.

Valuation of Different Bonds: Dive into zero-coupon bonds, fixed-rate bonds, floating-rate notes, and more.

This module is essential for mastering the Fixed Income section of the CFA® Level I curriculum. By understanding bond valuation, you'll be better equipped to analyze fixed-income investments and make informed financial decisions.

Who Should Watch:

CFA® Level I candidates preparing for 2025 exam.

Finance students and professionals seeking a deeper understanding of bond valuation.

Anyone interested in fixed-income investments and how they are priced.

Stay Connected:

If you find this video helpful, please like and share it with others.

Subscribe to our channel for more insightful content on CFA® exam topics and finance.

Feel free to comment below with any questions or insights—you might just help a fellow learner!

Доступные форматы для скачивания:

Скачать видео mp4

-

Информация по загрузке: