CRA Takes 80% When You Die

Автор: The Advisors Table Podcast

Загружено: 2025-12-26

Просмотров: 16829

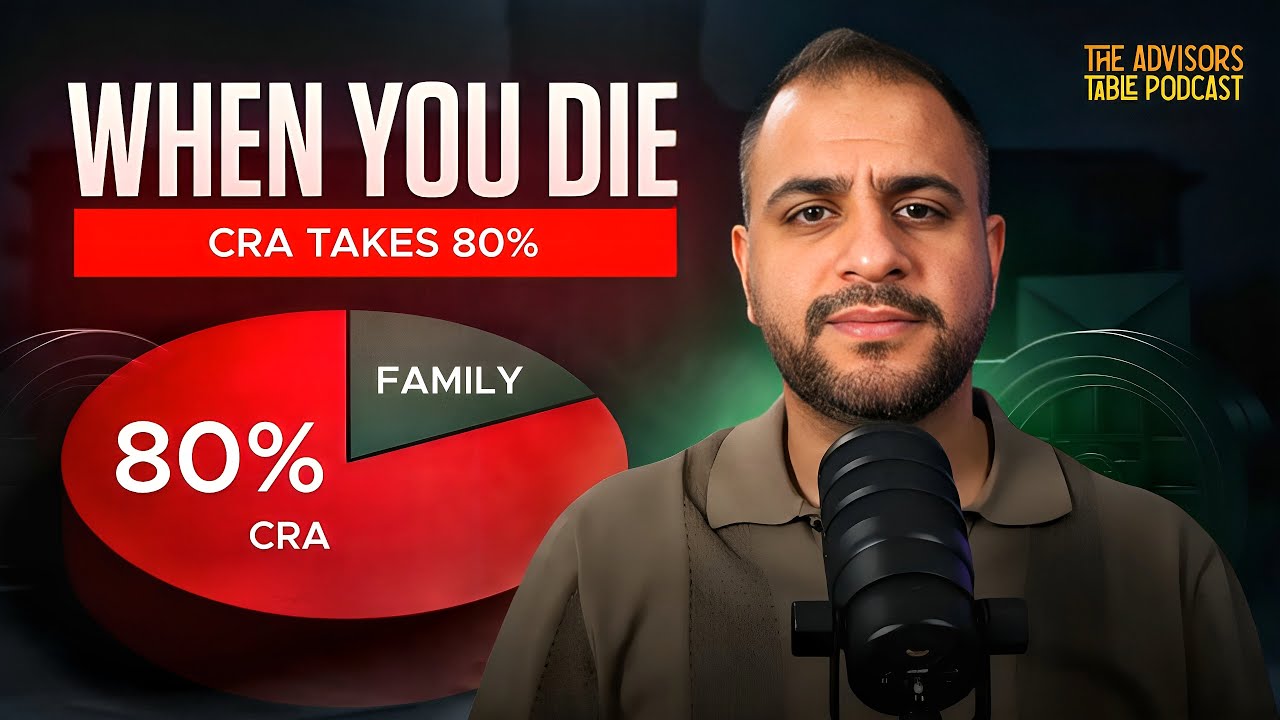

When you die owning a corporation in Canada, the CRA can take up to *80% of its value through layers of taxation — leaving your family with almost nothing.

In this video, I break down how this actually happens using a simple $1 million corporation example, and why most business owners only discover this problem when it’s already too late.

You’ll learn:

• How CRA applies a deemed disposition when you die

• How a $1M corporation can trigger over $800K in total taxes

• How capital gains tax, dividend tax, and corporate tax stack together

• What “double” and “triple” taxation really mean in practice

• What post-mortem tax planning is

• What strategies can reduce the tax outcome from ~80% down to ~27%

• Why this issue affects employees, jobs, and entire communities — not just owners

• The three questions every incorporated business owner must ask their tax advisor

Here's the blog related to this topic on our website - https://theadvisorstable.com/dont-let...

If you own a corporation, this is something you cannot afford to ignore. Without planning, years of work can disappear to taxes in a single event.

📥 Blog*:* “5 Questions to Ask Your Advisor” checklist at *theadvisorstable.com*

🔔 Subscribe for more practical Canadian tax and business insights

💬 Comment if you’ve seen this happen in real life — or if you want a second set of eyes on your situation

#AdvisorsTable #CanadianTax #EstatePlanning #BusinessOwners #CRA

Доступные форматы для скачивания:

Скачать видео mp4

-

Информация по загрузке: