Overview of Asset Allocation (2025 Level III CFA® Exam – Reading 4)

Автор: AnalystPrep

Загружено: 2022-10-30

Просмотров: 17853

Master Reading 4 of the CFA® Level III curriculum with Professor James Forjan. This lesson explains why asset allocation is the most important decision in the investment process and shows how strong investment governance and a clear Investment Policy Statement (IPS) drive better portfolios. You’ll learn how to build a strategic asset mix, model an economic balance sheet (including human capital), and manage risk and rebalancing—without getting lost in formulas.

What you’ll learn

Elements of effective investment governance & IPS

Strategic vs tactical/dynamic asset allocation

Economic balance sheet: extended assets & liabilities

Asset-only, liability-relative, and goals-based approaches

Risk budgeting, constraints, monitoring, and rebalancing best practices

Study with AnalystPrep:

Level I: https://analystprep.com/shop/cfa-leve...

Level II: https://analystprep.com/shop/learn-pr...

Level III: https://analystprep.com/shop/cfa-leve...

Levels I, II & III (Lifetime access): https://analystprep.com/shop/cfa-unli...

Prep Packages for the FRM® Program:

FRM Part I & Part II (Lifetime access): https://analystprep.com/shop/unlimite...

Topic 2 – Asset Allocation and Related Decisions in Portfolio Management

Reading 4 – Overview of Asset Allocation

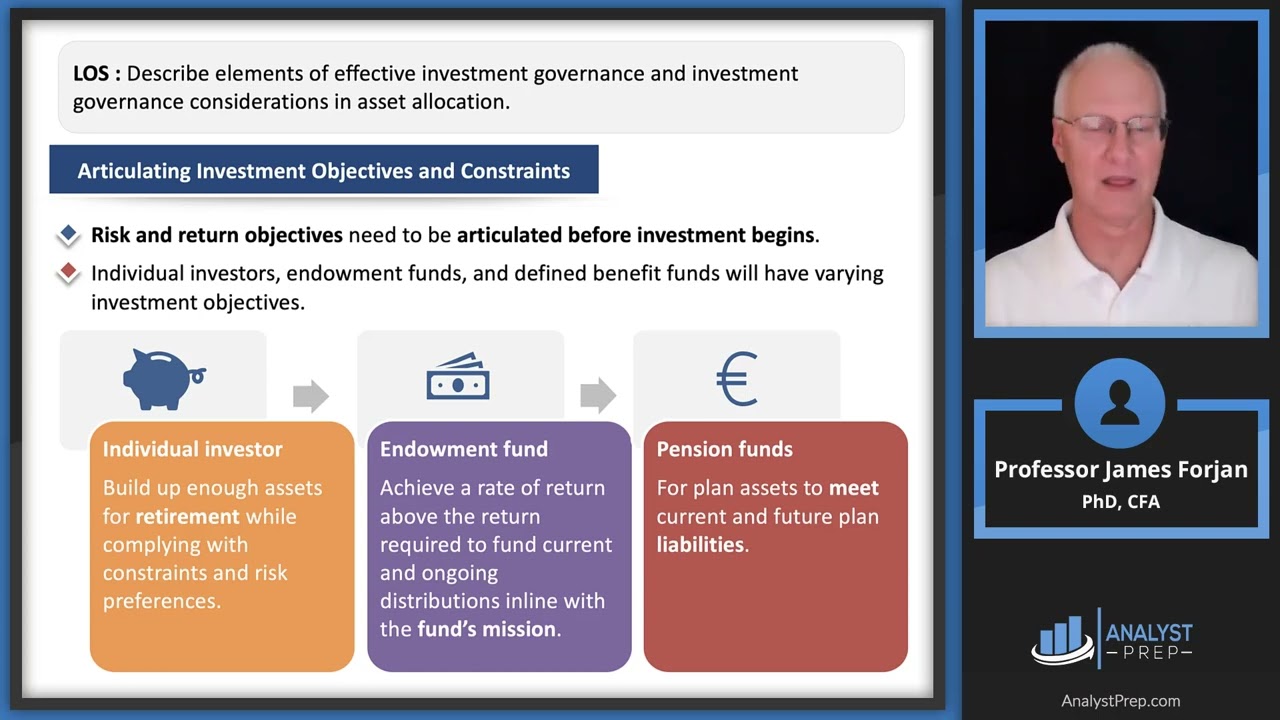

LOS : Describe elements of effective investment governance and investment governance considerations in asset allocation.

LOS : Formulate an economic balance sheet for a client and interpret its implications for asset allocation.

LOS : Compare the investment objectives of asset-only, liability-relative, and goals based asset allocation approaches.

LOS : Contrast concepts of risk relevant to asset-only, liability-relative, and goals based asset allocation approaches.

LOS : Explain how asset classes are used to represent exposures to systematic risk and discuss criteria for asset class specification.

LOS : Explain the use of risk factors in asset allocation and their relation to traditional asset class-based approaches.

LOS : Recommend and justify an asset allocation based on an investor’s objectives and constraints.

LOS : Describe the use of the global market portfolio as a baseline portfolio in asset allocation.

LOS : Discuss strategic implementation choices in asset allocation, including passive/active choices and vehicles for implementing passive and active mandates.

LOS : Discuss strategic considerations in rebalancing asset allocations.

#CFA #CFALevelIII #AssetAllocation #PortfolioManagement #InvestmentGovernance #InvestmentPolicyStatement #StrategicAssetAllocation #RiskManagement #Rebalancing #MonteCarlo #FactorInvesting #AnalystPrep

Доступные форматы для скачивания:

Скачать видео mp4

-

Информация по загрузке: