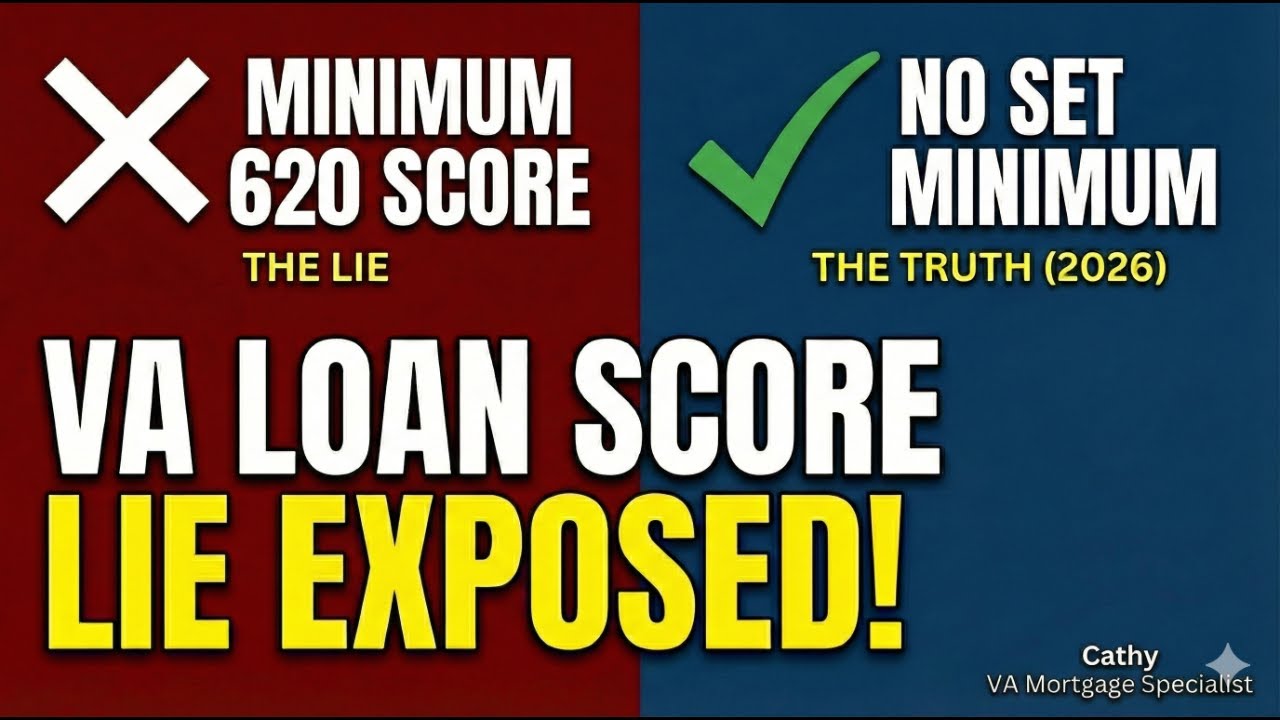

VA Loan Minimum Credit Score 2026 (Explained): Underwriting, Middle Score & Overlays

Автор: Cathy Sabater Mortgage Broker & VA Specialist

Загружено: 2026-01-12

Просмотров: 6

Before you pay collections, dispute accounts, or start credit repair, get a VA strategy first. Timing can backfire and delay approvals.

I’m Cathy Sabater, Mortgage Broker & VA Loan Specialist nmls 373470 Licensed in CA, TX, FL, NV, GA

Want a VA plan? Comment VA PLAN or reach out directly.

If you’re a veteran and you were told your credit score isn’t high enough for a VA loan—pause. In 2026, many VA denials are caused by lender overlays and misunderstandings of what VA underwriting actually looks at.

In this video, I break down:

✅ Why you have 3 credit scores Experian, Equifax, TransUnion

✅ Why mortgage lenders use the MIDDLE score

✅ The truth: the VA does not publish a minimum credit score

✅ What a lender overlay is and how it changes approvals

✅ How underwriting reviews collections, charge-offs, and late payments

✅ The 5 questions underwriters actually ask behavior - score

If you’re trying to decide whether to lock or float, buy now or wait, this will help you understand what’s really moving your rate so you’re not just guessing based on headlines.

Video Timestamp:

00: Intro

37: Question 1 - Denied VA Guidelines or Lender Overlay

1:01: Cover VA Loan Requirement

1:18: Credit Scores

1:56: Don't Damage Your Credit - Ask How

2:07: Sect 1 Three Credit Scores

2:32 Experian, Equifax & Transunion

3:01 Scenario App vs Lender

5:08 VA Myth - VA Does Not Publish Min Credit Score Requirement

5:30 VA Credit Rules

5:55: What is an Overlay?

7:41 Section 3 Five Questions you should ask yourself Qtn 1

8:38 Qtn 2 Housing History

9:33 Qtn 3 Residual Income

10:55 Qtn 4 Patterns

12:45 Section 4 Collections

14:11 Charge-offs

15:03 Late Payments

15:25 Scenario

15:56 Section 5 Manual Underwriting

17:22 Buyer Take Aways

📞 Cathy Sabater | Mortgage Broker & Proud Veteran | 619-846-2675

Helping you build wealth through real estate

🌎 Licensed in CA • TX • FL • NV • GA | nmls 373470

Company: Empire Home Loans | nmls #1839243. Equal Housing Opportunity Lender.

*Disclaimer:* Education only. Not a commitment to lend. Approval varies by borrower profile, lender overlays, and appraisal. Loan limits subject to change annually by FHFA.

📌 Ready to Talk About Your Numbers?

Get a personalized mortgage rate strategy based on your budget, timeline, and credit profile.

📅 Schedule a Free 15-Minute Strategy Call:

https://scheduler.zoom.us/cathy-s2aba...

🏠 Apply or See If You Qualify:

https://empire.my1003app.com/373470/r...

⭐ Check Out My Reviews:

https://www.zillow.com/lender-profile...

va loan credit requirements, va loan credit score, va minimum credit score 2026, va loan denied, va loan underwriting, va loan overlays, lender overlays, middle credit score, tri merge credit report, experian equifax transunion, va loan collections, charge offs va loan, late payments va loan, manual underwriting va loan, aus vs manual underwriting, va home loan 2026, va mortgage, va loan eligibility, san diego mortgage broker, cathy sabater, nmls 373470

00:00 Introduction

00:37 Question 1

01:01 Cover VA Loan Requirements

01:18 Credit Scores

01:56 Don't Damage Your Credit Get Prof'l Advise

02:07 Section 1 - Three Credit Scores

02:32 Experian Equifax Transunion

03:01 Scenario App vs Lender

05:30 VA Credit Rule

05:55 Waht is Overlay - Denial or Approval

07:41 Section 3 5 Questions Ask Yourself Qtn 1

08:38 Qtn 2 Housing History

09:33 Qtn 3 Residual Income

10:55 Qtn 4 Credit Patterns

12:45 Seciton 4 Collections

14:11 Charge Offes

15:03 Late Payments

15:24 Scenario

15:56 Section 5 Manual Underwriting

17:22 Take Aways

Доступные форматы для скачивания:

Скачать видео mp4

-

Информация по загрузке: