Data Mining on Agricultural Customer Data of a Financial Institution

Автор: sajee khaengrit

Загружено: 2020-07-31

Просмотров: 187

DATA MINING ON AGRICULTURAL CUSTOMER DATA OF

A FINANCIAL INSTITUTION

Panida Agassopha*, Sajee Khaengrit, Oattachai Saengmat

Advisor: Assoc. Prof. Dr. Chartchai Leenawong

Faculty of Science, King Mongkut’s Institute of Technology Ladkrabang, Bangkok, THAILAND

email: 59050092@kmitl.ac.th

Abstract:

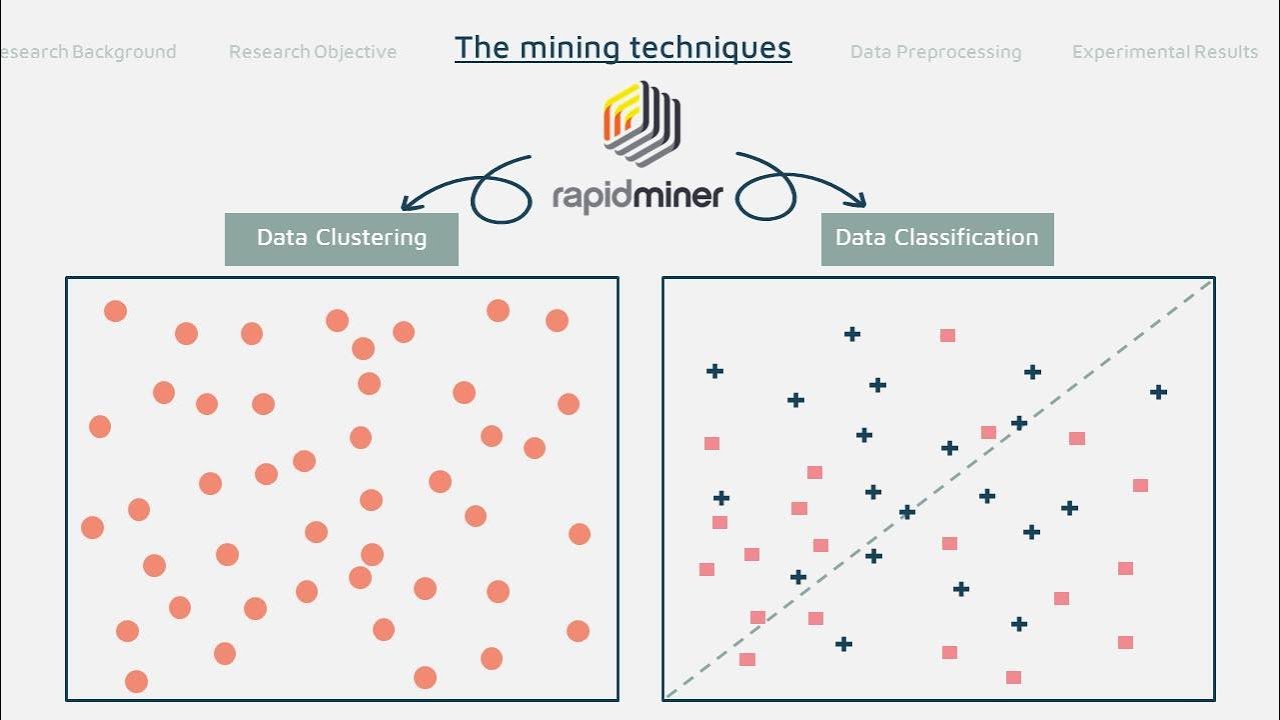

This research aims at improving the quality of life for farmers and finding business opportunities for an agricultural financial institution using Data Mining. The techniques used are Data Clustering and Data Classification. The analytical results obtained can help support the decisions regarding loan approvals for farmers to use in improving their productivities and, thus, their lives. Financial institution in the agricultural sector divides the customers into 3 groups according to their policy, which are S1 Clients registering for state welfare, S2 Clients not enrolled in the state welfare and S3 Farmers groups, farmer institutions and juristic

Part 1: Data Clustering

For S2 and S3 customers, we do the clustering by K-Means using Rapid Miner based on various attributions.

For S2 customers, the results show that the financial institution should encourage the clients with low deposits, low debts, and low NPLs in each economic crop group to form a cluster. Then, the financial institution provides them loans for buying machinery and tools that will help them make better quality crops, and more productively too.

For S3 customers, the results show that the financial institution should focus on the mid-stream group (collecting/processing) and help them find business opportunities.

Part 2: Data Classification

Compare the efficiency in predicting the results of informal debt by the Decision Tree, the K-Nearest-Neighbor and the Naive Bayes techniques with accuracy values. The three techniques are applied on the S1 client data. Most clients are prone to informal debts. The results show that Decision Tree is most effective in predicting the results of informal debt which will help support decisions for future loan approval.

#Clustering #Classification #RapidMiner #NPLs

Доступные форматы для скачивания:

Скачать видео mp4

-

Информация по загрузке: