How Much Car You Can ACTUALLY Afford (By Income) - Not What You Think!

Автор: Graham Stephan

Загружено: 2025-08-18

Просмотров: 202645

Get 80% off your first month of Kikoff - Sign up today at https://getkikoff.com/graham - Enjoy! Let's discuss how much car you can afford in 2025, the different methods for affordability, and how to save as much money as possible - Add me on Instagram: GPStephan

GET MY WEEKLY EMAIL MARKET RECAP NEWSLETTER: http://grahamstephan.com/newsletter

The YouTube Creator Academy:

Learn EXACTLY how to get your first 1000 subscribers on YouTube, rank videos on the front page of searches, grow your following, and turn that into another income source: https://the-real-estate-agent-academy... - $100 OFF WITH CODE 100OFF

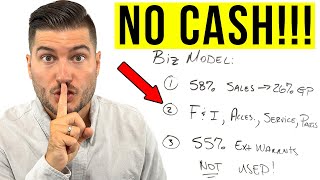

THE 20/3/8 RULE:

20% Down Payment

3-Year Loan

8% Of Your Income - Maximum

These numbers are meant for people who want to prioritize paying down their loan as soon as possible, live below their means, and ensure that they have enough left over to save and invest.

THE 20/4/10 RULE:

20% Down Payment

4-Year Loan

10% Of Your Income - Maximum

This is similar to the above, but allows you to buy slightly more car by extending your loan an extra year and bumping up your payments.

THE DAVE RAMSEY METHOD:

He says: The car you can afford is the car you can buy outright, in cash. In addition to that, he practices the belief that the total value of your cars should NEVER cost more than 50% of your annual salary.

THE 10/10 METHOD:

The Financial Samurai Blogger recommends spending NO MORE than 10% of your gross income on a car that you keep for at least 10 years. Owning a reliable used car like this allows you the discretionary income to invest elsewhere, you won’t have the financial stress of being burdened by high payments, and you’ll be financially free to spend in other areas where you might get more personal enjoyment.

LENDER QUALIFICATIONS:

Most lenders DO NOT care about the above...instead, as long as you can make the monthly payments, they'll give you a loan at the most you can possibly get. Even more concerning, some lenders are willing to finance up to 125% of the cars value - so, if you bought a car for $30,000, they could give up to $37,500 to include sales tax, registration, title, and license fees.

Personally, I think if you JUST need a car for commuting - pick something that’s used, affordable, good on gas, and costs less than 10% of your gross income to pay off entirely within 3 years (if you can’t buy it outright in cash). This gives you the best value while spending as little money as possible.

For business inquiries, you can reach me at [email protected]

*Point increase based on observed VantageScore 3.0 changes for Kikoff customers with starting credit below 600 who made consistent, on-time payments. Current as of February 2024. Payment history & other behavioral factors can impact results. Individual results may vary.

*Some of the links and other products that appear on this video are from companies which Graham Stephan will earn an affiliate commission or referral bonus. Graham Stephan is part of an affiliate network and receives compensation for sending traffic to partner sites. The content in this video is accurate as of the posting date. Some of the offers mentioned may no longer be available. This is not investment advice.

Доступные форматы для скачивания:

Скачать видео mp4

-

Информация по загрузке: