Depreciation expense and Accumulated Depreciation. Financial Accounting

Автор: Farhat Lectures. The # 1 CPA & Accounting Courses

Загружено: 2024-09-01

Просмотров: 8392

In this video, we will discuss depreciation expense and accumulated depreciation.

Start your free trial: ✅https://farhatlectures.com/courses/fi...

0:00 Introduction

This video explains depreciation from an accounting perspective. Here's a quick summary:

Depreciation Defined (1:30): Depreciation is a method to allocate the cost of a tangible asset over its useful life. It's not the same as loss of value due to market conditions.

Matching Principle (2:03): The purpose of depreciation is to match the expense of an asset with the revenue it generates over its life.

Depreciable Assets (4:24): Depreciation applies to tangible, fixed assets like machinery, vehicles, and equipment, but not land. Land isn't depreciated because its life is unlimited (5:12).

Salvage Value (6:53): Salvage value is the estimated value of an asset at the end of its useful life. It's subtracted from the asset's cost to determine the depreciable amount.

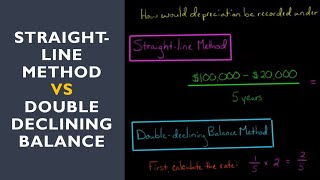

Straight-Line Method (8:17): This method spreads the cost of an asset evenly over its useful life. The depreciation expense is the same each year (9:11).

Journal Entry (11:14): The journal entry to record depreciation is debit depreciation expense and credit accumulated depreciation.

Book Value (13:45): Book value is the cost of an asset minus its accumulated depreciation. The presentation on the balance sheet would still show the original cost minus the accumulated depreciation (15:42).

Understanding Depreciation Expense and Accumulated Depreciation

Depreciation is a fundamental accounting concept used to allocate the cost of a tangible asset over its useful life. This process recognizes the wearing out, consumption, or other loss of value of a physical asset, such as machinery, vehicles, or buildings. Here, we delve into two key components of depreciation: depreciation expense and accumulated depreciation.

1. Depreciation Expense

Depreciation expense represents the portion of the total cost of a tangible asset that is considered to be consumed during a specific accounting period. This expense is recognized on the income statement and impacts the profit and loss of a company.

Purpose: The primary purpose of recording depreciation expense is to reflect the usage and economic reduction in value of an asset over a given period, adhering to the matching principle of accounting. This principle dictates that expenses should be matched with the revenues they help generate.

Calculation: Depreciation expense can be calculated using various methods, each suitable for different types of business activities and asset types:

Straight-Line Method: This method spreads the cost of the asset evenly over its useful life. It is calculated by dividing the depreciable base (cost minus salvage value) by the useful life of the asset.

Declining Balance Method: A form of accelerated depreciation where a fixed percentage of the book value of the asset is expensed each year, leading to higher expenses in the earlier years.

Units of Production Method: Calculates depreciation based on the usage or output of the asset rather than the passage of time.

2. Accumulated Depreciation

Accumulated depreciation is a contra asset account on the balance sheet that records the total depreciation expense that has been charged against a fixed asset since it was acquired and put into use.

Purpose: Accumulated depreciation serves to show the aggregate impact of depreciation on the historical cost of assets. It helps determine the net book value (cost minus accumulated depreciation) of the assets.

Account Behavior: Unlike typical asset accounts that have a debit balance, accumulated depreciation has a credit balance. It increases with each debit to the Depreciation Expense account and reduces the gross amount of fixed assets reported on the balance sheet.

3. Accounting Entries

When recording depreciation, the typical journal entries for each accounting period are:

Debit Depreciation Expense: This increases the expense on the income statement, reducing net income for the period.

Credit Accumulated Depreciation: This increases the total accumulated depreciation on the balance sheet, reducing the book value of the asset.

4. Example of Depreciation Accounting

Consider a company that purchases a machine for $10,000, expected to have a salvage value of $1,000 at the end of its useful life of 5 years. Using the straight-line method, the annual depreciation expense would be calculated as follows:

Depreciable Base: $10,000 - $1,000 = $9,000

Annual Depreciation Expense: $9,000 / 5 years = $1,800

Each year, the journal entry would be:

Debit Depreciation Expense $1,800

Credit Accumulated Depreciation $1,800

#onlinecourses #onlinecourses #onlinecoursesfree

Доступные форматы для скачивания:

Скачать видео mp4

-

Информация по загрузке: