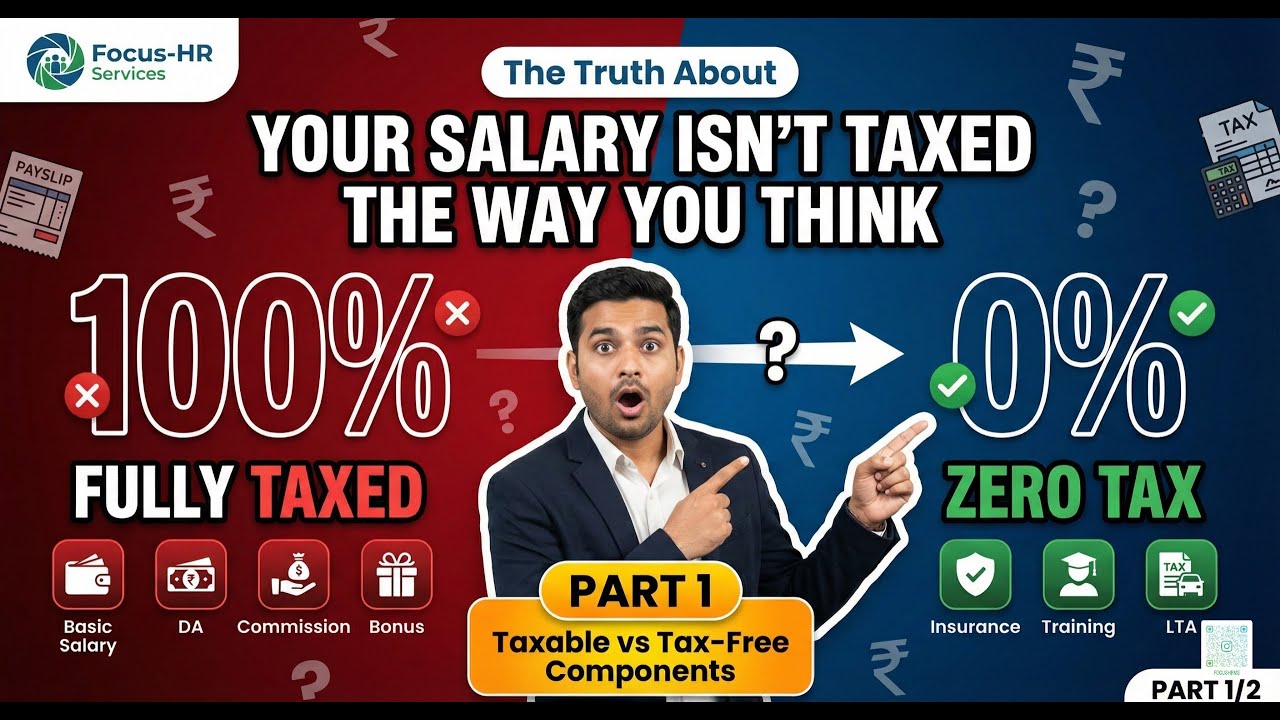

Taxable vs Tax-Free Salary Components EXPOSED | Part 1

Автор: Focus - HR Management Services

Загружено: 2026-01-09

Просмотров: 59

NOT ALL YOUR SALARY IS TAXED THE SAME WAY! Here's the complete breakdown of Taxable vs Tax-Free Salary Components.

In Part 1 of our Payroll Types & Classifications series, I expose the truth about:

✅ Which salary components are FULLY TAXED (100%)

✅ Which components are COMPLETELY TAX-FREE (0%)

✅ Which components are PARTIALLY TAX-FREE (the sneaky ones)

✅ Real examples: HRA, DA, Medical Allowance, LTA, and more

✅ How you could be losing ₹50,000 to ₹1 lakh per year

💰 KEY TAKEAWAYS:

Basic Salary = 100% Taxable

HRA = 40-50% Taxable (with proper documentation)

LTA = Tax-Free (twice in 4 years)

Insurance Premiums = 100% Tax-Free

Travel Allowance = ₹19,200/year tax-free

Medical Allowance = ₹15,000/year tax-free

#PayrollIndia, #SalaryTax, #TaxFreeComponents, #HRA, #IncomeeTax, #PayslipExplained, #SalaryStructure, #FocusHR, #PayrollProcessing, #DMRC, #LTA, #dA

#Salary, #TaxableComponents, #TaxFreeIncome, #HRA, #SalaryTax, #PayrollIndia, #IncomeTax, #Allowances, #TaxPlanning, #SalaryBreakdown, #LTA, #MedicalAllowance, #TravelAllowance, #Deductions, #PayslipExplained, #FocusHR, #HRIndia, #CareerAdvice, #FinancialPlanning, #TaxSaving, #SalaryStructure, #IndianTaxSystem, #PayrollManagement, #EmployeeBenefits, #WagesAndSalaries, #TaxBenefits, #SalaryNegotiation, #PayrollTips, #TaxExemption, #salarycomponents

Taxable salary components, tax-free salary India, HRA tax exemption, DA allowance taxation, LTA tax benefit, medical allowance tax-free, payroll tax calculation, salary components breakdown, income tax deduction, partially tax-free allowance, how much salary is taxable, which allowances are tax-free, HRA medical allowance difference, travel allowance tax benefit, bonus taxation rules, fringe benefits taxation, conveyance allowance tax, entertainment allowance exemption, job-related training tax-free, life insurance premium tax-free, why HRA is partially taxable, how to claim HRA exemption properly, ₹19,200 travel allowance calculation, ₹15,000 medical allowance limit, what makes salary taxable or not, salary structure tax optimization, how much tax comes from salary, partially exempt allowances India, fully taxable income components, tax-free components of salary, communication allowance tax, entertainment allowance rules, basic salary taxation, dearness allowance tax, special allowance taxable, bonus tax implications, overtime payment tax, fringe benefits valuation, perquisite tax calculation, salary negotiation tax planning, payroll processing tax rules, employee benefits taxation, statutory deductions explained, voluntary deductions difference, salary structure optimization India, tax-saving salary components, allowance tax exemption limits, documentation for tax exemption, rent receipts HRA claim, travel bills LTA claim, medical bills reimbursement, tax planning for employees, payroll for HR professionals, Indian payroll system explained, salary tax breakdown India, complete guide to salary taxation, understanding payslip deductions, maximize take-home salary, reduce taxable income legally, salary component classification, payroll types India, compensation structure breakdown, employee remuneration taxation, wage and salary taxation India, income tax on salary components, exempt allowances list India, taxable perquisites examples, salary tax optimization strategies, payroll management best practices, HR payroll compliance guide, salary calculation methods India, tax-efficient salary structuring, employee compensation taxation, Indian labor law payroll, salary slip component analysis, take-home salary maximization tips, payroll deduction categories, statutory vs non-statutory salary components, allowance exemption documentation requirements.

Salary Tax, HRA Tax Exemption, Taxable Components, Tax-Free Salary, Payroll India, Income Tax, LTA Benefit, Medical Allowance, Travel Allowance, Conveyance Allowance, Basic Salary, DA Taxation, Bonus Tax, Overtime Pay, Fringe Benefits, Salary Breakdown, CTC Components, Gross Salary, Net Salary, In-Hand Salary, Payslip Explained, Tax Planning, Salary Structure, HR India, Payroll Management, Tax Deduction, Allowance Tax, HRA Claim, Tax Saving, Employee Benefits, Statutory Deductions, Salary Components, Payroll Processing, Tax Optimization, Take-Home Salary, Salary Calculation, Indian Payroll, Tax-Free Allowances, Partially Taxable, Entertainment Allowance, Food Coupons Tax, Communication Allowance, Job Training Tax, Life Insurance Tax, Accident Insurance, Perquisite Tax, Tax Compliance, Salary Negotiation, HR Compliance, Employee Compensation

💬 DROP A COMMENT:

What percentage of YOUR salary is actually taxable? Let me know in the comments!

⚠️ DISCLAIMER: This video is for educational purposes only. Please consult with a tax professional for personalized advice based on your specific situation.

© 2026 Focus-HR Services. All Rights Reserved.

Доступные форматы для скачивания:

Скачать видео mp4

-

Информация по загрузке: