How To Avoid Taxes From Borrowed Money Tax Tuesday |

Автор: Toby Mathis Esq | Tax Planning & Asset Protection

Загружено: 2022-07-20

Просмотров: 58977

12:24 Is the money I get from a line of credit or loan taxable? What's the best way to avoid taxes on money borrowed and used on investments?

Welcome back to another installment of Tax Tuesday! There are a lot of questions to cover in this episode so tune in as Toby Mathis, Esq. and Jeff Webb, CPA break them down.

0:00 Intro

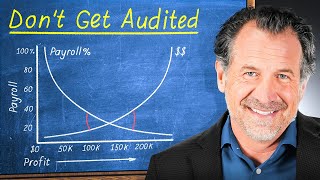

21:04 If 100% of your income comes from royalties, which aren't subject to the 15.3% self-employment tax, at what point does it make sense to create an LLC/S-Corp in order to have the royalties go to the business so that you can pay yourself a salary and distributions?

26:25 I want to sell my property that belongs to my private foundation and buy my own primary residence as a 1031 Exchange with this foundation to avoid taxes. Do I have to have a corporation to do this, or will a private foundation be ok?

32:27 I am co-owner of a property, I don't get proceeds from rent, but I want to invest in renovations. Are there any tax advantages for me?

35:59 I started a vending machine business as a franchisee in 2020 through an LLC. Because of my material participation, I wrote off 100% of my vending equipment against my LLC earnings and my other employment W2 earnings within the first two years. If I can no longer qualify under IRS rules and become considered passive, what are the implications?

41:17 What is the best way to set up an LLC for a partnership if you want to be certified as a Veteran Owned Small Business (VOSB)?

46:29 How can I write off or expense the cost of finishing for my primary residence that will be purposed late this year as a furnished short or mid-term rental property?

54:14 If I move my paid-off condo to a trust, will the trust pay taxes on it? If I sell it 1 year after owning it, then put it in trust before I sell it. Will the trust pay taxes on it?

56:39 Can you provide more detail about capturing a Cap Gain Loss (Short Term) for digital assets (BTC)?

1:00:29 I'm looking to invest in multi-family syndications.

1:05:36 Should I put my college kid on my payroll for $24K-$30K/ yr rather than just pay their rent and expenses out of my pocket?

1:13:30 Outro

---------------------------------------------------------------------------------------------------------

SUBSCRIBE

https://aba.link/subscribe

~~~~

FREE REAL ESTATE INVESTMENT STRATEGY SESSION

Claim Your FREE 45-minute Investment Strategy Session to receive business planning tips and asset protection. 👉 https://aba.link/3f4

FREE TAX & ASSET PROTECTION WORKSHOP

Learn about Real Estate & Asset Protection from Clint Coons, Esq, and Toby Mathis, Esq. at our next all-day free Livestream from 9 am to 4 pm PT. on Saturdays. Our attorneys and specialists will answer ALL questions: Save Your Seat: https://aba.link/taptoby

TAX TUESDAY LIVE

Toby Mathis, Esq. and Jeff Webb, CPA will answer ALL your questions LIVE on Tax Tuesdays every other Tues 👉 https://aba.link/38f

OTHER ANDERSON ADVISOR EVENTS

Learn a rich selection of subjects like tax and asset protection, business, investing, and much more. Our partners, attorneys, and other skilled experts will help you learn what you need to know in order to better your chances of success in your professional life.

https://aba.link/tobyevents

~~~~

FINANCIAL PLANNING & TAX RESOURCES

📚 Order Your Copy of "Infinity Investing: How The Rich Get Richer And How You Can Do The Same" Here: 👉👉 👉 https://aba.link/xkz

Order Your Copy of ”Tax-Wise Business Ownership" and find greater success by taking advantage of tax laws for your business. Here 👉 https://aba.link/jwu

~~~~

FOLLOW US:

Instagram: https://aba.link/instagram

Facebook: https://aba.link/facebook

Twitter: https://aba.link/twitter

LinkedIn: https://aba.link/linkedin

TikTok: / tobymathisesq

~~~~

CONTACT US

Phone: 800.706.4741

Email: [email protected]

Fax: 702.664.0545

ABOUT TOBY MATHIS

Toby Mathis, Esq. is the best-selling author of Infinity Investing: How the Rich Get Richer And How You Can Do The Same. Toby is a tax attorney and founded Anderson Business Advisors, one of the most successful law, tax, and estate planning companies in the United States. Learn more at https://aba.link/tobyaba

---------------------------------------------------------------------------------------------------------

The information provided in this video should not be construed or relied on as legal advice for any specific fact or circumstance. Its content was prepared by Anderson Business Advisors with its main office at 3225 McLeod Drive Suite 100 Las Vegas, Nevada 89121. This video is designed for entertainment and information purposes only. Viewing this video does not create an attorney-client relationship with Anderson Business Advisors or any of its lawyers. You should not act or rely on any of the information contained herein without seeking professional legal advice.

Доступные форматы для скачивания:

Скачать видео mp4

-

Информация по загрузке: