Put Call Parity with Dividends

Автор: Mike, the Mathematician

Загружено: 2023-01-31

Просмотров: 1714

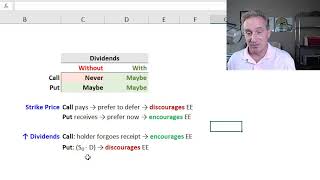

We prove Put Call parity in the case when the underlying security pays a dividend through a no-arbitrage argument. This argument assumes that the options are European.

#mikedabkowski, #mikethemathematician, #profdabkowski, #mathfinance

Доступные форматы для скачивания:

Скачать видео mp4

-

Информация по загрузке: