Order Flow Toxicity Explained: A Complete Guide to VPIN

Автор: WaveLabs

Загружено: 2025-12-21

Просмотров: 78

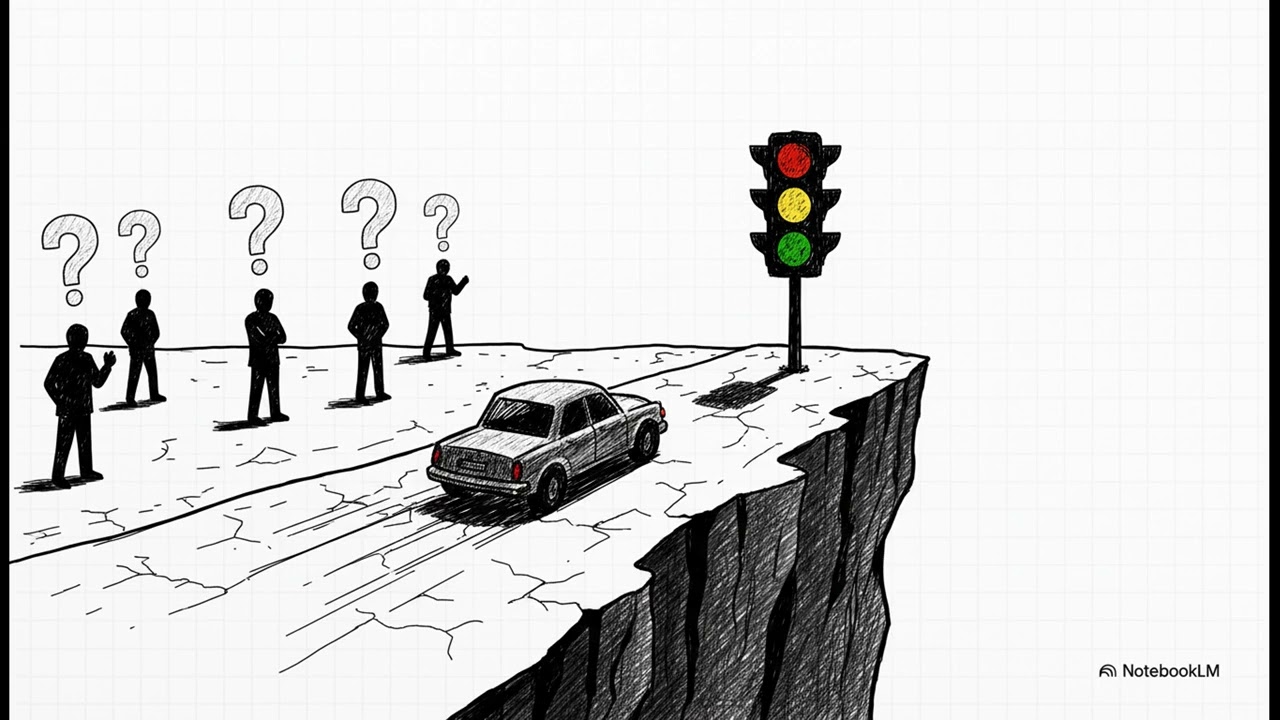

The 2010 Flash Crash wiped out a trillion dollars in minutes, but one metric known as VPIN may have signaled the collapse an hour before it happened.

In this deep dive, we unpack the controversy behind Order Flow Toxicity and the VPIN (Volume-Synchronized Probability of Informed Trading) metric. Was this really an early warning system for the financial world's version of a Category 5 hurricane, or just a mechanical mirage? We explore how High-Frequency Trading (HFT) impacts liquidity, the battle between academic creators and critics, and whether retail traders can actually use this institutional tool to survive the next market event.

Video Chapters:

0:00 The "Invisible" Crash Predictor

0:38 What is Order Flow Toxicity?

1:21 VPIN: Clock Time vs. Volume Time

1:58 The May 6, 2010 Flash Crash

2:54 The 0.9 Warning Signal

3:31 The Critics: Is VPIN a "Mechanical Mirage"?

4:38 The Feedback Loop Flaw

5:18 How Market Makers Actually Use VPIN

6:36 Centralized vs. Fragmented Markets

7:03 The Verdict: Crystal Ball or Risk Tool?

❓ Trader Question:

Do you believe algorithmic indicators can truly predict "black swan" events, or is the market too chaotic to model perfectly? Let me know your thoughts below.

🚀 Support the Channel:

👍 Like this video if you want more Quant/Market Structure breakdowns.

🔔 Subscribe to master the hidden mechanics of the market.

#VPIN #FlashCrash #AlgorithmicTrading #MarketMicrostructure #QuantitativeFinance #OrderFlow #DayTrading #MarketMakers #FinancialHistory #HFT

Доступные форматы для скачивания:

Скачать видео mp4

-

Информация по загрузке: