The Earliest (& Safest) Time to Stop Saving for Retirement

Автор: James Conole, CFP®

Загружено: 2023-12-02

Просмотров: 158438

Investing for the future is a commendable and necessary goal for financial security, especially in retirement. However, there comes a point when continuing to save may have diminishing returns, sacrificing current experiences for a future that might be overly secured. In this blog post, we'll delve into a real client case study and explore the principles of compounding and opportunity cost that led to a surprising recommendation: to stop saving for retirement.

Tommy and Linda:

Tommy and Linda, a couple in their early to mid-fifties, approached us for financial planning. They were diligent savers, with a net worth approaching two and a half million dollars, a result of consistent saving, wise investments, and even the liquidation of significant stock options.

Their retirement portfolio included 401(k)s, Roth IRAs, a joint trust account, and valuable real estate assets. With a projected portfolio growth rate of 8%, they were on track to accumulate a substantial retirement nest egg by the time they reached their late sixties.

Goals and Dilemmas:

Tommy loved his job and planned to work until age 67, while Linda, a stay-at-home mom, wanted to focus on family. Their financial goals included $6,000 per month for basic living expenses, $15,000 annually for travel, and accounting for healthcare costs.

However, the couple expressed a desire for more family time and lamented the lack of available funds for meaningful experiences due to their aggressive retirement savings strategy, which included maxing out the 401(k) and contributing to Roth IRAs.

We applied two crucial principles in financial planning to assess Tommy and Linda's situation: compounding and opportunity cost.

Compounding:

Compounding works over time. In the early years, contributions played a significant role in portfolio growth, but as the portfolio size increased, the market's impact became more substantial. This illustrated that, over time, the portfolio could potentially grow on its own without the need for aggressive contributions.

Opportunity Cost:

By persistently saving for a future that might be over-secured, they risked missing out on valuable experiences with their children, especially during these critical teenage years.

The Decision to Pause Retirement Savings:

In a surprising turn, we recommended that Tommy and Linda pause their additional retirement savings. While we advised them to continue receiving the employer match in the 401(k), we suggested redirecting the surplus funds toward creating immediate and memorable family experiences.

The Impact:

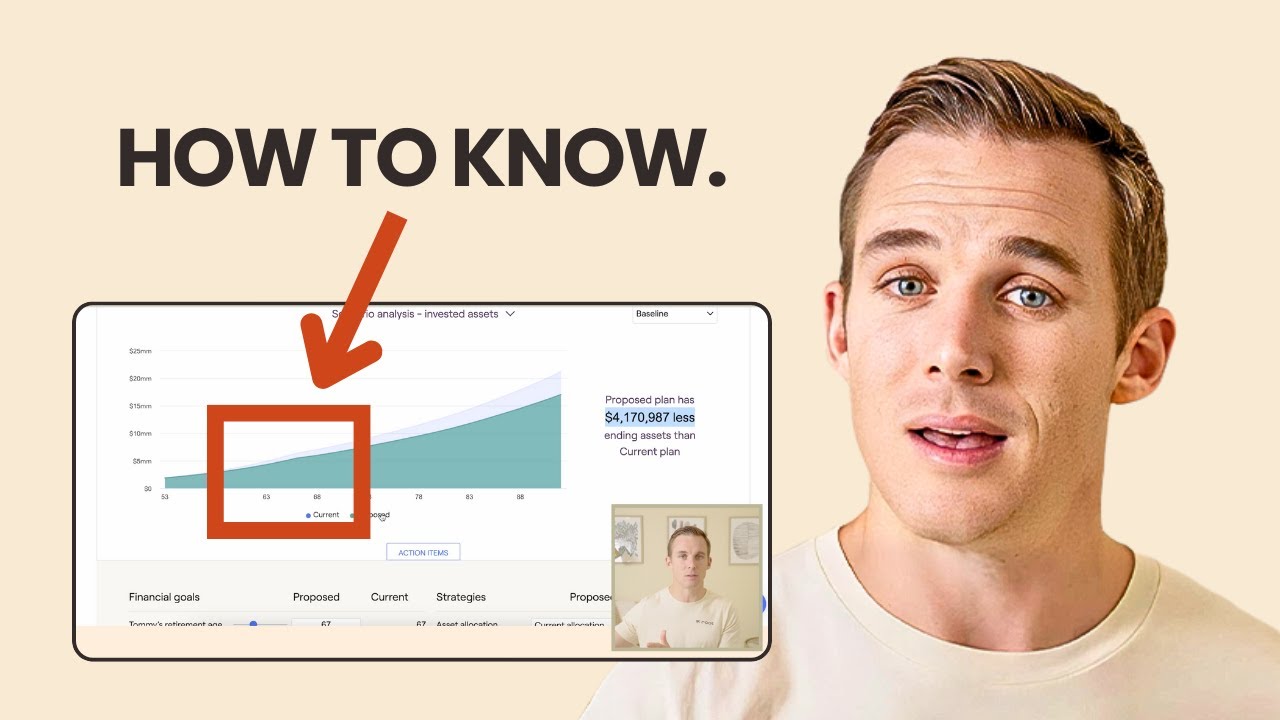

Rerunning the projections with reduced retirement contributions showed a $4 million decrease in the projected portfolio at age 90. However, the couple still had a comfortable margin to meet all their retirement needs, including basic living expenses, travel, and healthcare.

Tommy and Linda's case serves as a compelling example of when it might make sense to pause retirement savings. The principles of compounding and opportunity cost, when carefully considered, can guide individuals and couples towards a more balanced financial plan—one that not only secures the future but also allows for the enjoyment of life's precious moments today. Don't let retirement be the sole consuming goal; instead, strive for a more aligned life that blends prudent planning with the joy of the present.

=======================

Learn the tips & strategies to get the most out of life with your money.

Get started today → https://www.rootfinancialpartners.com/

Get access to the retirement software I use in this video and more → https://retirement-planning-academy.m...

🔔 Make sure to subscribe here to be notified for future videos!

/ @rootfp

_ _

👥 Make sure to connect with us on all socials below → https://beacons.ai/rootfinancialpartners

⏱Timestamps:⏱

0:00 Too prepared for retirement?

1:03 A case study

3:46 Consider your values

5:51 Project out

7:59 Cashflow summary

11:06 Projection and reevaluation

13:06 Years you can’t get back

15:46 Two principles

18:53 Questions to ask yourself

Other videos we think you'll like:

About Root: • Financial advisors with heart.

Worried about retirement?

Start here: • Worried About Retirement..Start With a Bla...

Доступные форматы для скачивания:

Скачать видео mp4

-

Информация по загрузке: