Real business cycle

Автор: VISHNU ECONOMICS SCHOOL

Загружено: 2021-03-07

Просмотров: 17057

#ECONOMICFORUPSC #Vishnueconomicsschool #NTANETECONOMICS

Download my app Vishnu ECONOMICS SCHOOL from play store or link is given below

https://play.google.com/store/apps/de...

TELEGRAM ;- https://t.me/Vishnueconomicsschool

WHATSAPP https://chat.whatsapp.com/Dd4096hYSAL...

APP https://play.google.com/store/apps/de...

WEBSITE www.vishnueconomicsschool.in

We cover

1. UPSC MAIN ECONOMICS OPTIONAL

2. NTA - NET ECONOMICS

3. INDIAN ECONOMIC SERVICES

4. RBI EXAM 5 NABARD EXAM

6. DSSSB PGT ECONOMICS

7 KVS/ NVS PGT ECONOMICS

8.PGT ECONOMICS FOR OTHER STATE

9 LECTURER UPHESB

10 IGNOU MA ECONOMICS

11 Delhi UNIVERSITY B.A, B.COM, ECO H, GE, ECO H

12 MDU UNIVERSITIES

13 MA ECO, M.COM, ECO H, BBE, BBA, MBA,

14 . CBES BORAD FOR 11 AND 12

15 NIOS FOR CLASS 12

16. ICSE CLASS 12

17 XI , XII FOR DIFFERENT STATE BOARD

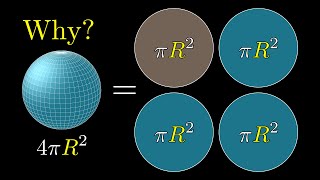

Real business-cycle theory (RBC theory) is a class of new classical macroeconomics models in which business-cycle fluctuations to a large extent can be accounted for by real (in contrast to nominal) shocks. Unlike other leading theories of the business cycle,[citation needed] RBC theory sees business cycle fluctuations as the efficient response to exogenous changes in the real economic environment. That is, the level of national output necessarily maximizes expected utility, and governments should therefore concentrate on long-run structural policy changes and not intervene through discretionary fiscal or monetary policy designed to actively smooth out economic short-term fluctuations.

According to RBC theory, business cycles are therefore "real" in that they do not represent a failure of markets to clear but rather reflect the most efficient possible operation of the economy, given the structure of the economy.

RBC theory is associated with freshwater economics (the Chicago School of Economics in the neoclassical tradition).

If we were to take snapshots of an economy at different points in time, no two photos would look alike. This occurs for two reasons:

Many advanced economies exhibit sustained growth over time. That is, snapshots taken many years apart will most likely depict higher levels of economic activity in the later period.

There exist seemingly random fluctuations around this growth trend. Thus given two snapshots in time, predicting the latter with the earlier is nearly impossible.

A common way to observe such behavior is by looking at a time series of an economy's output, more specifically gross national product (GNP). This is just the value of the goods and services produced by a country's businesses and workers.

.

Economists have come up with many ideas to answer the above question. The one which currently dominates the academic literature on real business cycle theory[citation needed] was introduced by Finn E. Kydland and Edward C. Prescott in their 1982 work Time to Build And Aggregate Fluctuations. They envisioned this factor to be technological shocks—i.e., random fluctuations in the productivity level that shifted the constant growth trend up or down. Examples of such shocks include innovations, bad weather, imported oil price increase, stricter environmental and safety regulations, etc. The general gist is that something occurs that directly changes the effectiveness of capital and/or labour. This in turn affects the decisions of workers and firms, who in turn change what they buy and produce and thus eventually affect output. RBC models predict time sequences of allocation for consumption, investment, etc. given these shocks.

But exactly how do these productivity shocks cause ups and downs in economic activity? Consider a positive but temporary shock to productivity. This momentarily increases the effectiveness of workers and capital, allowing a given level of capital and labor to produce more output.

Individuals face two types of tradeoffs. One is the consumption-investment decision. Since productivity is higher, people have more output to consume. An individual might choose to consume all of it today. But if he values future consumption, all that extra output might not be worth consuming in its entirety today. Instead, he may consume some but invest the rest in capital to enhance production in subsequent periods and thus increase future consumption. This explains why investment spending is more volatile than consumption. The life-cycle hypothesis argues that households base their consumption decisions on expected lifetime income and so they prefer to "smooth" consumption over time. They will thus save (and invest) in periods of high income and defer consumption of this to periods of low income.

The other decision is the labor-leisure tradeoff. Higher productivity encourages substitution of current work for future work since workers will earn more per hour today compared to tomorrow. More labor and less leisure results in higher output today.

Доступные форматы для скачивания:

Скачать видео mp4

-

Информация по загрузке: