ACCA F9 - Business Finance |

Автор: FinanceSkul

Загружено: 2022-11-30

Просмотров: 3624

GET ACCESS TO MORE VIDEOS LIKE THIS.

Step 1: Subscribe to this channel / @financeskul

Step 2: Click the link below:

Link: https://www.patreon.com/posts/acca-f9...

This video will cover section E of ACCA’s F9 – Financial Management.

1. Sources of, and raising, business finance

2. Estimating the cost of capital

3. Sources of finance and their relative costs

4. Capital structure theories and practical considerations

5. Finance for small- and medium-sized entities (SMEs)

____________________________________________

_________________________________________

On successful completion of this video, you will be able to:

1. Sources of, and raising, business finance

a) Identify and discuss the range of short-term sources of finance available to businesses, including:

i) Overdraft

ii) Short-term loan

iii) Trade credit

iv) Lease finance.

b) Identify and discuss the range of long-term sources of finance available to businesses, including:

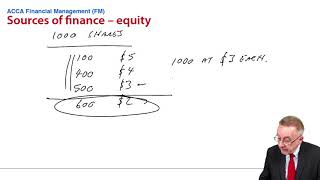

i) Equity finance

ii) Debt finance

iii) Lease finance

iv) Venture capital.

c) Identify and discuss methods of raising equity finance, including:

i) Rights issue

ii) Placing

iii) Public offer

iv) Stock exchange listing.

d) Identify and discuss methods of raising short- and long-term Islamic finance, including:

i) Major differences between Islamic finance and the other forms of business finance.

ii) The concept of riba (interest) and how returns are made by Islamic financial securities.

iii) Islamic financial instruments available to businesses including:

I) m .

2. Estimating the cost of capital

a) Estimate the cost of equity including:

i) Application of the dividend growth model, its assumptions, advantages and disadvantages.

ii) Explanation and discussion of systematic and unsystematic risk

iii) Relationship between portfolio theory and the capital asset pricing model (CAPM)

iv) Application of the CAPM, its assumptions, advantages and disadvantages.

b) Estimating the cost of debt:

i) Irredeemable debt

ii) Redeemable debt

iii) Convertible debt

iv) Preference shares

v) Bank debt.

c) Estimating the overall cost of capital including:

i) Distinguishing between average and marginal cost of capital

ii) Calculating the weighted average cost of capital (WACC) using book value and market value weightings.

3. Sources of finance and their relative costs

a) Describe the relative risk-return relationship and the relative costs of equity and debt.

b) Describe the creditor hierarchy and its connection with the relative costs of sources of finance.

c) Identify and discuss the problem of high levels of gearing.

d) Assess the impact of sources of finance on financial position, financial risk and shareholder wealth using appropriate measures, including:

i) Ratio analysis using statement of financial position gearing, operational and financial gearing, interest coverage ratio and other relevant ratios

ii) Cash flow forecasting

iii) Leasing or borrowing to buy.

e) Impact of cost of capital on investments

4. Capital structure theories and practical considerations

a) Describe the traditional view of capital structure and its assumptions.

b) Describe the views of Miller and Modigliani on capital structure, both without and with corporate taxation, and their assumptions.

c) Identify a range of capital market imperfections and describe their impact on the views of Miller and Modigliani on capital structure.

d) Explain the relevance of pecking order theory to the selection of sources of finance.

5. Finance for small- and medium-sized entities (SMEs)

a) Describe the financing needs of small businesses.

b) Describe the nature of the financing problem for small businesses in terms of the funding gap, the maturity gap and inadequate security.

c) Explain measures that may be taken to ease the financing problems of SMEs, including the responses of government departments and financial institutions.

d) Identify and evaluate the financial impact of sources of finance for SME's.

Tags:

#acca course

#accaf5

#accaf6

#accaf7

#accaf8

#accaf9

#accaSBL

#accaSBR

#accaAPM

#accaAFM

#accaATX

#accaAAA

#accountancy

#managementaccounting #financialaccounting #taxation #auditandassurance #performancemanagement #financialmanagement #strategicbusinessleader #strategicbusinessreporting #corporatelaw #businessanalysis #financialreporting

#advancedfinancialmanagement #advancedperformanceManagement #advancedtaxation #advancedauditandassurance #advancedfinancialreporting #advancedcorporatelaw #accountancy #charteredaccountancy #examtips #studyadvice #revisiontips #passACCA

Доступные форматы для скачивания:

Скачать видео mp4

-

Информация по загрузке: