Basel 2, Part 1 by Khurram Zaheer Chishti FRM FMVA CBCA SCR AFM

Автор: Khurram Chishti FRM FMVA CBCA SCR AFM NLP

Загружено: 2025-07-20

Просмотров: 267

This is second lecture of Basel series and part 1 of Basel 2 lecture.

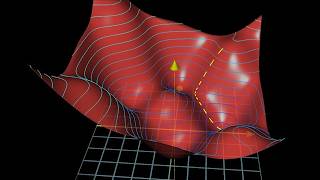

Basel II is the second of the Basel Accords introduced by the Basel Committee on Banking Supervision (BCBS) to strengthen the regulation, supervision, and risk management of the banking sector. Implemented in the mid-2000s, Basel II builds on the foundation of Basel I by introducing a more risk-sensitive framework that links capital requirements to the actual risk profile of banks. It is structured around three mutually reinforcing pillars: minimum capital requirements (Pillar 1), supervisory review (Pillar 2), and market discipline (Pillar 3).

The importance of Basel II lies in its ability to improve risk measurement, especially for credit, market, and operational risks. By allowing banks to use internal models to assess risks, it encourages better risk management practices. Furthermore, it enhances transparency and accountability through public disclosures, strengthening market discipline. Overall, Basel II represents a major step toward aligning capital adequacy with the true risk exposure of banks.

Доступные форматы для скачивания:

Скачать видео mp4

-

Информация по загрузке: