The 1923 Wealth Transfer: How Hyperinflation Created Billionaires

Автор: Economy Breakdown

Загружено: 2025-11-23

Просмотров: 175

The 1923 Wealth Transfer: How Hyperinflation Created Billionaires

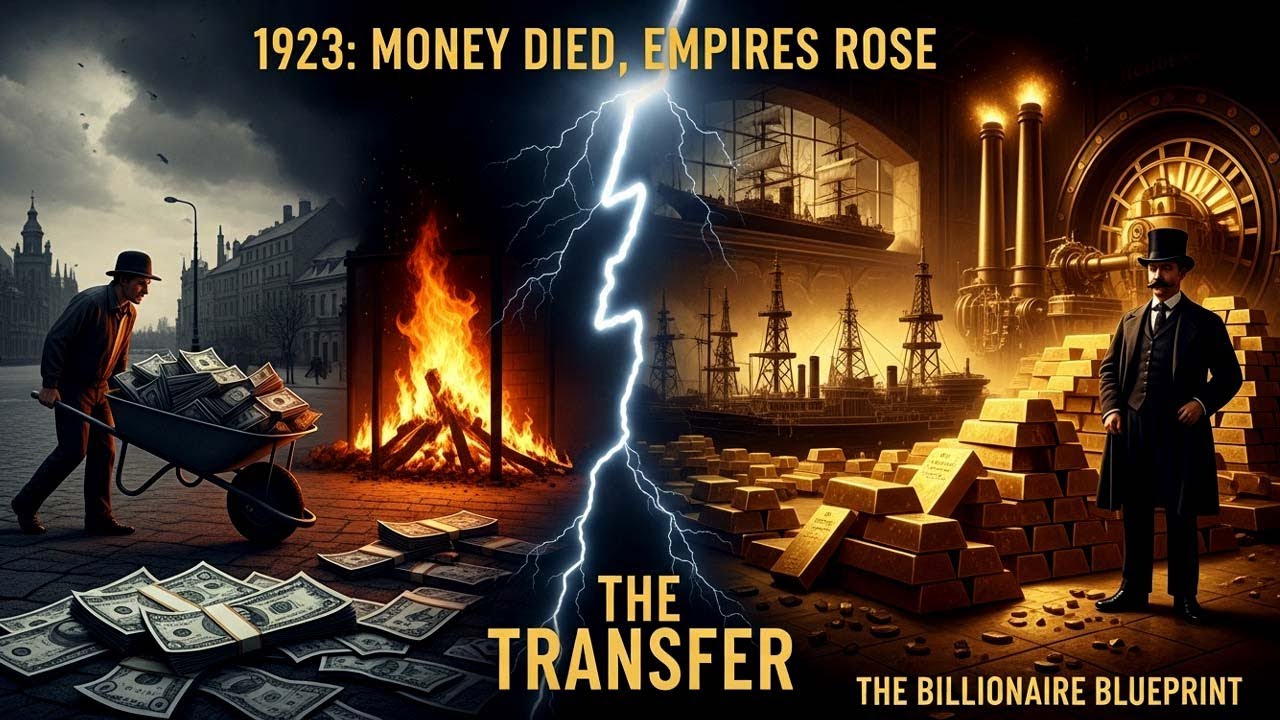

Hyperinflation isn’t just a chapter in economic history — it is a wealth transfer machine, a silent force that wipes out the savings of millions while creating a handful of ultra-rich winners. We’ve all seen the iconic images of Weimar Germany: wheelbarrows full of worthless cash, children stacking banknotes like building blocks, families burning money because it was cheaper than firewood. But behind these dramatic visuals lies a deeper, darker truth — a truth most people never learn.

While ordinary citizens watched their life savings evaporate overnight, a small group of people quietly became some of the richest individuals in European history. And they didn’t get rich despite the collapse of the currency — they got rich because of it. This video uncovers exactly how that happened, and why the same pattern is repeating in today’s global financial system.

In the heart of the Weimar crisis stood one man: a ruthless, brilliant industrialist who would later be called the “Inflation King.” His strategy was shockingly simple yet devastatingly effective. He borrowed massive amounts of rapidly devaluing currency, converted it into real assets like factories, coal mines, ships, and land, and then waited as hyperinflation destroyed the value of his debts. In a few years, he controlled a staggering share of German industry — all bought with money that eventually became worthless.

This wasn’t luck. It was a blueprint.

A 4-step mechanism so powerful that wealthy elites, corporate giants, and governments still use it today:

Step 1: Borrow money in a currency that is losing value.

Step 2: Immediately convert that money into real assets.

Step 3: Wait for inflation to erode the real cost of the debt.

Step 4: Repay loans with devalued currency while keeping the hard assets.

In this video, we break down exactly how this strategy worked in 1923 and how the same playbook is being quietly used in America today. From corporations that borrowed billions at near-zero interest rates to buy factories and real estate, to billionaires loading up on farmland, energy, and infrastructure, the pattern is unmistakable. The people who borrow to buy real things win. The people who save lose.

If you thought hyperinflation was a thing of the past, think again. History doesn’t repeat — it rhymes. The United States has printed more money in the last five years than in the previous century. Global debt has crossed $300 trillion. Governments today are trapped between impossible debt loads and political instability. Like Germany in 1919, they face a choice: default openly, or inflate silently.

And history shows they always choose inflation.

This video exposes why inflation is not just rising prices — it is a silent tax on your savings, a hidden mechanism that rewards debtors and punishes savers. It explains how your bank balance may stay the same while your purchasing power collapses. It reveals why cash holders, pensioners, and salary earners always end up paying the price.

More importantly, it reveals how the wealthy position themselves long before the crisis hits. They don’t hold dollars — they hold assets. They don’t trust the currency — they trust the math. And the math is brutally simple: in an inflationary world, real assets survive, paper assets die.

We will show you the chilling parallels between Weimar Germany and today’s global economy, from massive money printing to manipulated interest rates to exploding corporate leverage. We’ll explain what the billionaires are buying, what the governments are hiding, and what ordinary people need to understand before it’s too late.

This is not just a history lesson.

This is a warning.

If you want to understand how financial collapses truly work — who loses, who wins, and why — this video breaks it down step by step. You’ll never look at inflation, debt, or money the same way again.

👉 Watch till the end to understand the hidden mechanics behind today’s inflation crisis.

👉 Hit LIKE if financial truth matters to you.

👉 COMMENT “ready” if you want Part 2.

👉 SUBSCRIBE to stay ahead of the next major financial shift.

Доступные форматы для скачивания:

Скачать видео mp4

-

Информация по загрузке: