New Tip & Overtime Codes to W-2 (IRS Tax Form)

Автор: Teaching Tax Flow

Загружено: 2025-09-18

Просмотров: 1918

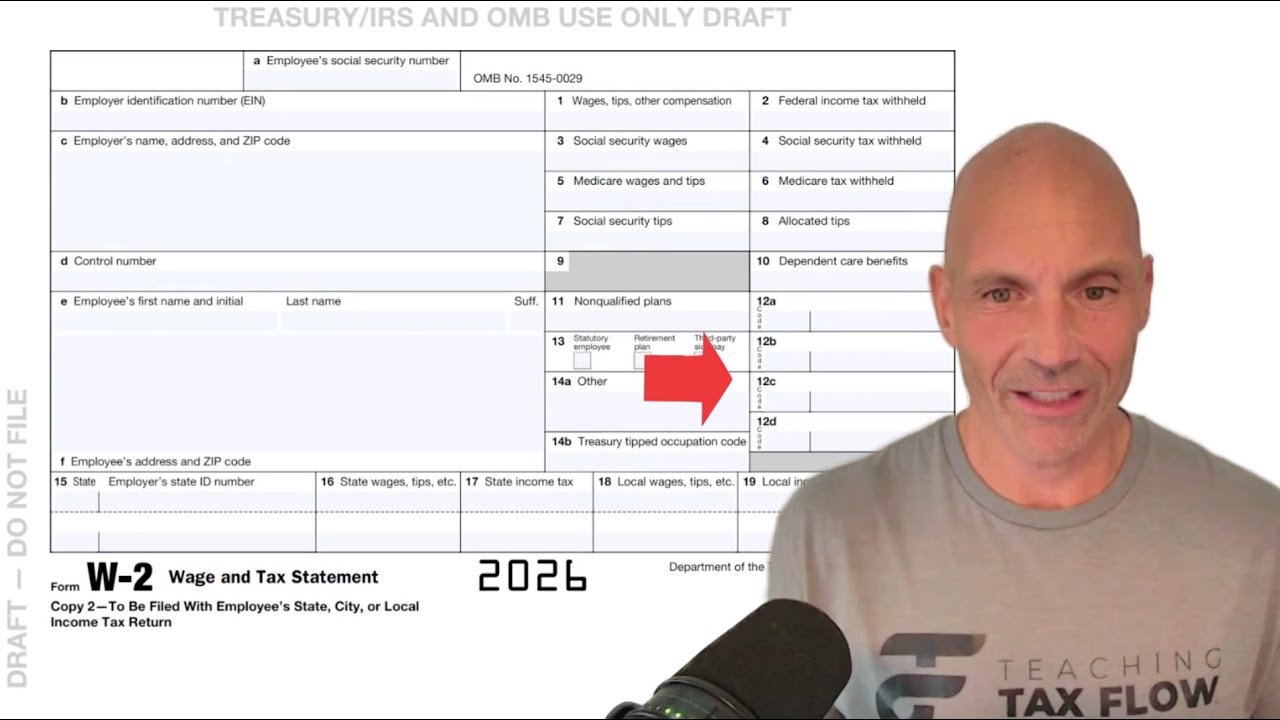

Chris Picciurro, CPA breaks down a little-known, but hugely important, update from the One Big Beautiful Bill Act (OB3): the addition of three new codes to Box 12 of the IRS Form W-2, affecting millions of workers who earn tips and overtime pay.

This video also shows you a first look at the draft 2026 W-2 form recently released by the IRS, explaining exactly what’s changed and what employers, employees, and tax pros need to watch for moving forward.

In this video, you’ll learn:

✅ What new W-2 Box 12 codes were added by OB3

✅ How tips and overtime are now reported using TP and TT codes

✅ What the new TA code means for Trump-style retirement accounts

✅ How this impacts federal and state-level tax reporting

✅ Why understanding these codes is critical for employers and employees alike

🎯 Key Highlights:

• OB3 introduces three new W-2 Box 12 codes for tax year 2026:

• TA — Employer contributions to Trump accounts

• TP — Reported cash tip income

• TT — Qualified overtime compensation

• These codes help clarify deductible and non-deductible income types

• Tip and overtime deductions are not automatic—but must be reported to be eligible

• Updates apply to all employers and states starting with 2026 W-2 filings

• Employers must ensure accurate categorization and reporting of compensation

Доступные форматы для скачивания:

Скачать видео mp4

-

Информация по загрузке: