Info Times SG

Welcome to Info Times SG!

On this channel you can learn essential skills in Accounting, Tally Prime, GST, TDS, Income Tax, and Computer Skills. Whether you're a student, professional, or business owner, our easy-to-follow tutorials and expert guidance will help you enhance your knowledge and improve your productivity.

📚 What you get:

Step-by-step tutorials on accounting concepts.

Basic to advance level Tally Prime software.

Simplified explanations of GST, TDS, and Income Tax.

Excel, GK & much more.

Real-world examples and solutions for your business and career needs.

💡 Why Subscribe?

Our content is designed to make learning accessible and enjoyable, helping you build confidence and achieve success in your professional journey.

Let’s learn and grow together! 🚀

Created & managed by: Sagar Kumar Jha

To get services of Accounting in Tally Prime, GST Return Filing, TDS Return filing, & Income Tax Return filing, feel free to mail us @ [email protected] 👇

Provision for expenses & Income Accrual Entries in Tally Prime | Journal Voucher Entries in Tally

Solution for Corrupt Data in Tally Prime | What to do if your Tally data gets Corrupted

GST Sales Invoice in Tally Prime | Local GST Bill To Ship To Invoices (Local & Interstate Consignee)

World's Most Valuable Companies | List of Top 15 Big Companies in the Universe

How to Apply for a New TAN (Tax Deduction Account Number) | TAN Application & Allotment Full Process

Learn how to file Online Income Tax Return for FY 2024-25 (AY 2025-26) | ITR Filing Process

Accounting, Taxes & Tally Prime Quiz - 14| Accountant Interview Questions with Answers | Tally Prime

Set Sales Invoice Numbering Format in Tally Prime | Configure of Tax Invoice Number Format in Tally

Income Tax Return Filing - Full Process | Online ITR Filing | ITR-2 | How to get Income Tax Refund

How to Deposit GST Challan | Create GST Challan | How to Pay GST | Make GST Challan Payment Online

New Company Creation in Tally Prime & GST Configurations to Enable GST in Tally Prime

How to Remove Uncertain Transactions in Tally Prime to File GSTR-1 Error Free | Error Free Jason

Accounting, Taxes & Tally Prime Quiz - 12| Accountant Interview Questions with Answers | Tally Prime

Local GST Sales Invoice with Auto-Calculated Output CGST & SGST in Tally Prime

Use of Freeze and Unfreeze Panes (Row & Column) in Excel | MS Excel Important Functions

How to remove Income Tax Demand | Deposit Demand Amount & Submit Response to Remove IT Demand

Creation of Inventory Masters & Use of Godowns in Tally Prime | Group, Category, Item, Unit & Godown

GSTR-1 HSN Summary & Document Issued Error Solved | Rectify Errors to File GSTR-1 | Table 12 & 13

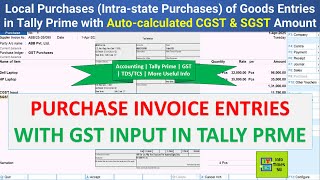

Purchase Entry with GST Input in Tally Prime | Local Purchases of Goods with Automatic CGST & SGST

Accounting, Taxes & Tally Prime Quiz - 12| Accountant Interview Questions with Answers | Tally Prime

Digitally Sign PDF Documents with DSC in Adobe Acrobat & Foxit Reader |Digital Signature Certificate

Print Invoices and Save Invoices as PDF in Tally Prime | Select Printer & Configure Print in Tally

Form 16A Download in PDF directly from CompuTDS | Download & Extract Form 16A PDFs from CompuTDS

GSTR 3B Return Filing Online | GSTR-3B Filing with DSC / EVC | DSC Configurations to File GST Return

Mutual Fund Purchase & Sale (loss on MF) Entries in Tally Prime | Buy & Redemption of MF in Tally

Accounting, Taxes & Tally Prime Quiz - 11| Accountant Interview Questions with Answers | Tally Prime

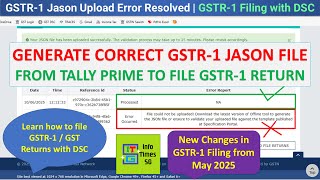

GSTR-1 Jason Error Solved | Generate Correct GSTR-1 Jason file from Tally Prime | Filing with DSC

Learn how to deposit TDS Challan | TDS payment on Income Tax Portal | TDS/TCS Deposit |94J & Others

Learn how to Alter & Delete Accounting Masters in Tally Prime | Tally Prime Basics

Email Directly from Tally Prime | Configure Gmail | Auto Mail Invoice, Ledger, Report in PDF & Excel