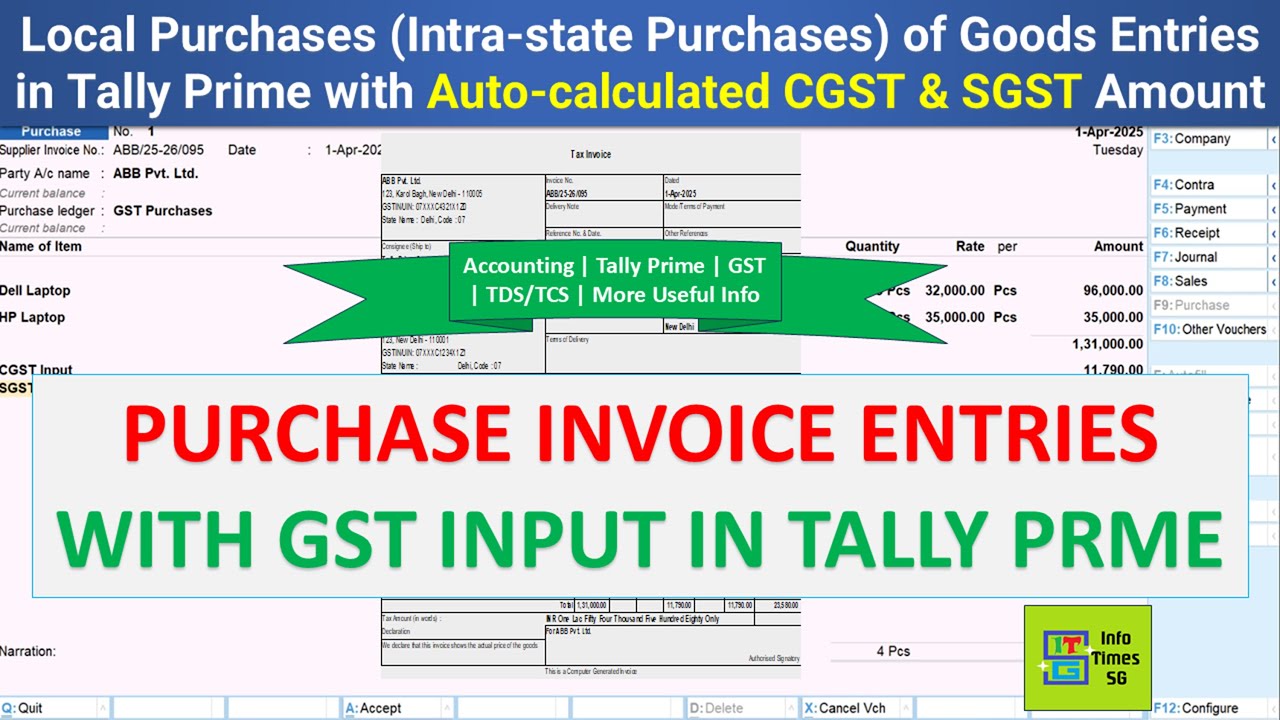

Purchase Entry with GST Input in Tally Prime | Local Purchases of Goods with Automatic CGST & SGST

Автор: Info Times SG

Загружено: 2025-07-03

Просмотров: 211

In this video you will learn how book purchase entry with GST Input in Tally Prime. Learn how to enter Local Purchases (within the state / Intra-state purchases) with Auto Calculated CGST & SGST Amounts in Purchase Voucher in Tally Prime

Join this channel to get solutions / advise💡 to all your queries and access🔓to exclusive videos📺:

/ @infotimessg-tallyprime_tech_gk

#215

#tallyprimefullcourse #tallyprime #accounting #accountancy #gst #gstin #gstintally

cgst and sgst in tally prime | gst tax auto calculate problem in tally prime | cgst sgst not calculate in tally | cgst and sgst in tally | gst auto calculation in tally prime | gst auto calculation problem in tally prime | why gst not calculated automatic in tally prime | cgst and sgst auto calciulation problem | gst auto calculate in tally | how to calculate stockwise gst in tally prime | gst auto calculate problem in tally | tally prime new error cgst & sgst nahi ho raha calculate | gst not calculate in tally prime | purchase entry with gst in tally prime | purchase entry in tally prime with gst | purchase and sales entry in tally prime with gst | tally prime purchase entry with gst | purchase entry with gst in tally | local and out of state purchase bill entry in tally prime | import goods under gst in tally prime | igst purchase sales entry in tally prime | tally prime gst purchase entry

_______________________________________________________________________________________

Our other videos:

Digitally Sign PDF Documents with DSC in Adobe Acrobat & Foxit Reader |Digital Signature Certificate

• Digitally Sign PDF Documents with DSC in A...

Print Invoices and Save Invoices as PDF in Tally Prime | Select Printer & Configure Print in Tally:

• Print Invoices and Save Invoices as PDF in...

GSTR 3B Return Filing Online | GSTR-3B Filing with DSC / EVC | DSC Configurations to File GST Return:

• GSTR 3B Return Filing Online | GSTR-3B Fil...

Mutual Fund Purchase & Sale (loss on MF) Entries in Tally Prime | Buy & Redemption of MF in Tally:

• Mutual Fund Purchase & Sale (loss on MF) E...

GSTR-1 Jason Error Solved | Generate Correct GSTR-1 Jason file from Tally Prime:

• GSTR-1 Jason Error Solved | Generate Corre...

Learn how to deposit TDS Challan | TDS payment on Income Tax Portal | TDS/TCS Deposit |94J & Others:

• Learn how to deposit TDS Challan | TDS pay...

Learn how to Alter & Delete Accounting Masters in Tally Prime | Tally Prime Basics:

• Learn how to Alter & Delete Accounting Mas...

Email Directly from Tally Prime | Configure Gmail | Auto Mail Invoice, Ledger, Report in PDF & Excel:

• Email Directly from Tally Prime | Configur...

Fixed Assets (Computer/Laptops) Purchase Entry with GST Input in Tally Prime :

• Fixed Assets (Computer/Laptops) Purchase E...

Interstate GST Sales Invoice in Tally Prime | Regular Interstate Tax Invoices in Tally Prime:

• Interstate GST Sales Invoice in Tally Prim...

Creation of Godowns & Usage of Godowns in GST Invoices in Tally Prime:

• Creation of Godowns & Usage of Godowns in ...

New Features of Bank Reconciliation in Tally Prime 6.0 and higher versions | Tally Prime Update:

• New Features of Bank Reconciliation in Tal...

Salary TDS return (24Q) fvu file generation through CompuTDS :

• TDS return (24Q) fvu file generation throu...

Local GST Sales Invoice in Tally Prime | Tax Invoice in Tally Prime | Intra-state Sales in Tally Prime:

• Local GST Sales Invoice in Tally Prime | T...

GSTR 1 Filing directly from Tally Prime | Generate & Upload GSTR-1 Jason File from Tally Prime:

• GSTR 1 Filing directly from Tally Prime | ...

Services Export Invoice with Zero Rated GST in Tally Prime | Nil Rated Export Invoice in Tally Prime:

• Services Export Invoice with Zero Rated GS...

Company Creation & GST Configuration in Tally Prime | Enable GST in Tally Prime:

• Company Creation & GST Configuration in Ta...

Use of Normal and Advance Calculator in Tally Prime | Auto Calculator & Basic in Tally Prime:

• Use of Normal and Advance Calculator in Ta...

Accrued Interest on Fixed Deposit Interest Earned on FD & TDS on FD Entries in Tally Prime:

• Accrued Interest on Fixed Deposit Interest...

Export Tax Invoice with GST in Tally Prime | Export of Service Tax Invoice with IGST in Tally Prime:

• Export Tax Invoice with GST in Tally Prime...

Learn GST Basics | Calculation of GST Payable | Output & Input GST | IGST, CGST & SGST / UTGST:

• Learn GST Basics | Calculation of GST Paya...

Fixed Asset Purchase Entry in Tally Prime | Car Purchase Entry with TCS in Tally Prime:

• Fixed Asset Purchase Entry in Tally Prime ...

Change & Set Tally Data Folder & Export Folder in Tally Prime | Load a Company on Startup of Tally:

• Change & Set Tally Data Folder & Export Fo...

Automatic TDS Entry with GST on Contractor Services in Tally Prime | TDS u/s 194C in Tally Prime:

• Automatic TDS Entry with GST on Contractor...

Key changes in Income Tax, TDS, and TCS introduced in the Union Budget 2025:

• Key changes in Income Tax, TDS, and TCS in...

TDS Challan Deposit Procedure on Income Tax Portal | Learn how to Pay TDS/TCS Challans Online:

• TDS Challan Deposit Procedure on Income Ta...

Доступные форматы для скачивания:

Скачать видео mp4

-

Информация по загрузке: