FBR Has Your Bank Details? | Financial Information Rules Explained for Govt Employees & Pensioners

Автор: Govt Employees Updates

Загружено: 2026-01-13

Просмотров: 249

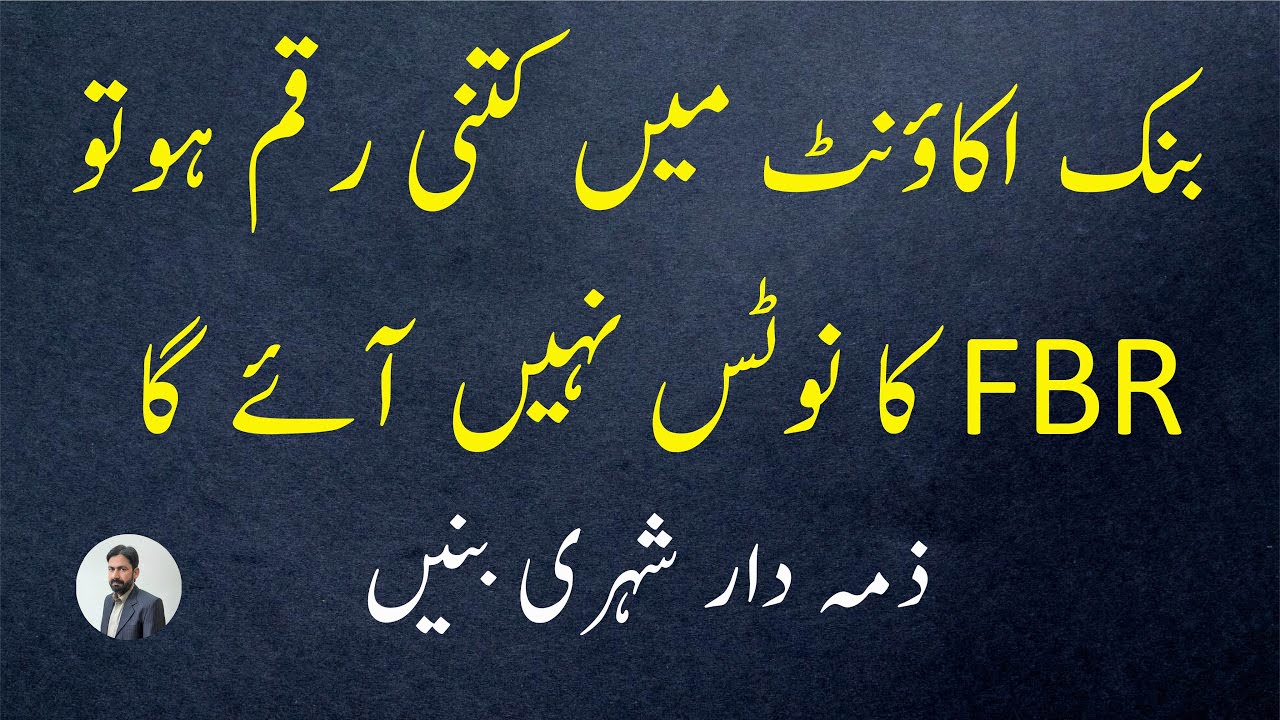

Banks, financial institutions, the Excise & Taxation, and the Land Record department in Pakistan are legally bound to share account holders’ financial information with the Federal Board of Revenue (FBR). Many government employees, pensioners, and family pensioners are unaware of what data is shared and how it can result in an FBR notice.

In this video on Govt Employees Updates, we clearly explain:

• What financial information banks share with FBR

• How FBR tracks bank accounts and transactions

• When FBR can issue a notice to salaried persons

• Income tax return obligations for government employees

• Impact on pensioners and family pensioners

This video is essential for:

• Salaried government employees

• Pensioners & family pensioners

• Anyone worried about FBR notices, tax compliance, and bank records

📌 Watch till the end to stay informed and avoid unnecessary tax issues.

Note: This video is for educational and informational purposes only.

#FBR #FBRNotice #IncomeTax #IncomeTaxReturn #GovtEmployees #Pensioners #FamilyPensioners #BankAccounts #TaxAwareness #GovtEmployeesUpdates

Доступные форматы для скачивания:

Скачать видео mp4

-

Информация по загрузке: