USD-PYG and Agricultural Export Prices: An Econometric Analysis | Jose Aurelio Fiorio Weberhofer

Автор: José A. Fiorio Weberhofer – Finance & Economics

Загружено: 2026-01-02

Просмотров: 12

USD-PYG exchange rate and agricultural export prices in Paraguay are analyzed using applied econometric methods. This research video is presented by Jose Aurelio Fiorio Weberhofer, independent researcher in finance and economics.

This video presents an applied econometric analysis of the relationship between the USD–Paraguay Guaraní (USD-PYG) exchange rate and agricultural export prices, with a focus on Paraguay’s external sector and commodity-driven exchange-rate dynamics.

My name is Jose Aurelio Fiorio Weberhofer, and I am an independent researcher in finance and economics, with research interests in exchange rates, commodity markets, applied econometric analysis, and emerging economies.

This study is a continuation of a previous video, where the relationship between the USD-PYG exchange rate and individual agricultural commodities was examined. In this extended analysis, the scope is broadened by constructing an aggregate agricultural export price index to better capture overall export price dynamics in Paraguay.

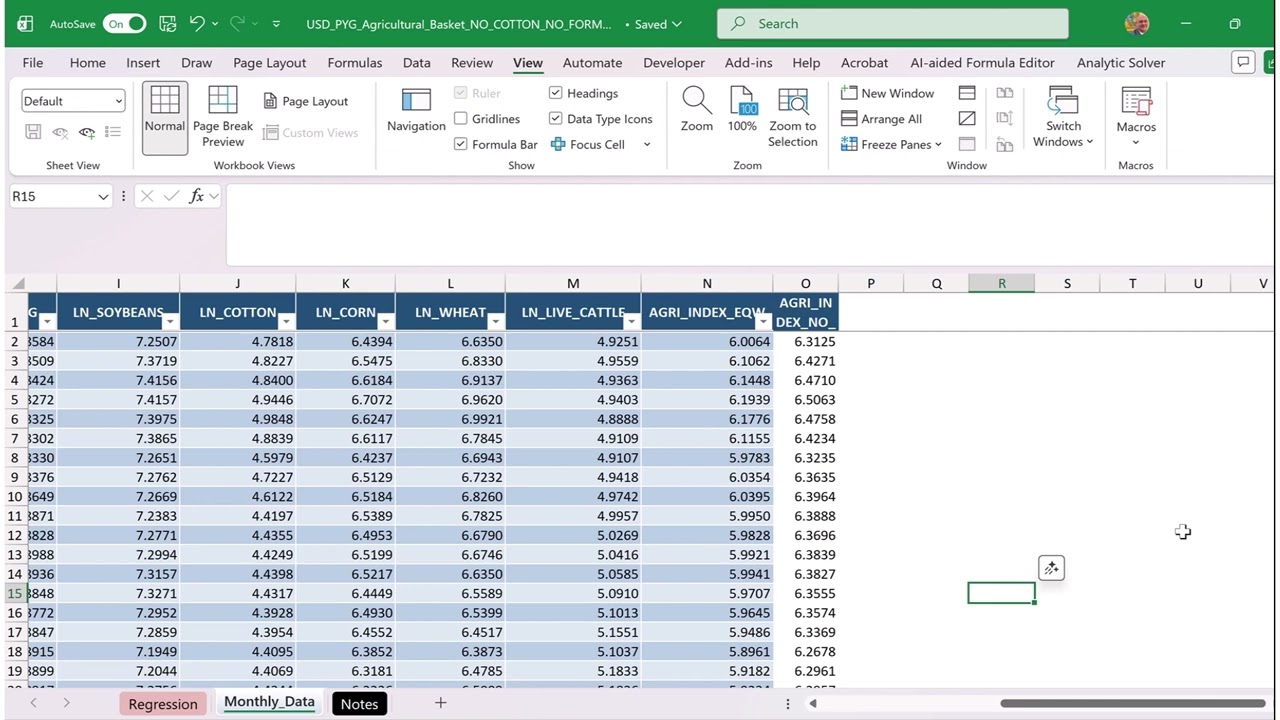

The agricultural export basket used in this analysis includes soybeans, corn, wheat, and beef, which together represent the core of Paraguay’s agricultural export sector. Cotton is excluded due to incomplete and inconsistent coverage in recent Paraguayan customs and export data.

The agricultural export price index is constructed using the natural logarithms of commodity prices. Although export-share weighting would be theoretically preferable—given the dominant role of soybeans in Paraguay’s exports—stable and fully consistent export-share data are not available for the full sample period. For this reason, an equal-weighting scheme is adopted as a conservative and robustness-oriented approach, avoiding measurement error while still capturing broad agricultural price movements.

All variables in the econometric model are expressed in logarithmic form, allowing the estimated coefficients to be interpreted as elasticities and improving the statistical properties of the regression.

The regression results indicate a strong and statistically significant relationship between agricultural export prices and the USD-PYG exchange rate. The model explains approximately 42% of the variation in the exchange rate using agricultural export prices alone. The estimated coefficient is negative and highly significant, indicating that increases in agricultural export prices are associated with an appreciation of the Paraguayan Guaraní, consistent with higher export revenues and stronger foreign-currency inflows.

The joint F-test confirms that the model is highly statistically significant, reinforcing the relevance of agricultural export prices in explaining exchange-rate dynamics in Paraguay.

Overall, the findings support the interpretation of Paraguay as a commodity-driven currency economy, where broad agricultural price movements play a central role in shaping exchange-rate behavior. Future extensions of this research may incorporate export-share weighting once fully consistent customs data become available, as well as monetary and global financial variables.

👤 Presented by: Jose Aurelio Fiorio Weberhofer

🎓 Independent Researcher in Finance and Economics

📊 Topics: USD-PYG Exchange Rate, Agricultural Export Prices, Paraguay Economy, Applied Econometrics, Commodity Markets, Emerging Economies

Доступные форматы для скачивания:

Скачать видео mp4

-

Информация по загрузке: