Using Monte Carlo Simulations to Calculate Value at Risk— for Risk Events

Автор: Corporater

Загружено: 2021-06-25

Просмотров: 7434

While using Monte Carlo simulations to calculate value at risk (VAR) for asset-based portfolios is well-established, it use in modeling VaR for risk events remains something of a mystery. This recorded webinar explores the principles behind Monte Carlo simulations, with a specific focus on risk events, and calculating VaR. Concepts covered: risk probability, risk impacts using distributions, percentiles and degrees of certainty, risk contribution by business unit or risk categories. Several practical examples are provided—you do not need to be a statistician to understand this presentation.

0:00 Introduction

0:46 Value at risk-Var- for risk managers

2:14 Why do we use Value at Risk?

3:10 Monte Carlo Simulations

3:53 Risk reporting

4:37 Assessing financial impact

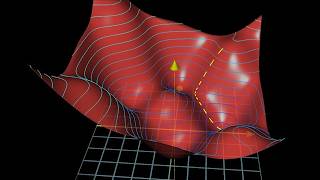

5:51 Modeling financial impact using distributions

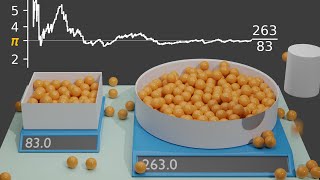

9:46 Two risks, uniform distribution

13:32 Dice example-in software

14:06 Dice example-40 dice

16:55 Aggregating risk

22:49 Triangular distribution

23:17 PERT distribution

23:59 Value at Risk-how it works We know the following

29:26 Examples

29:49 Histogram

30:11 Percentile table

30:45 Contribution

31:30 Using software

34:15 Advanced concepts

Доступные форматы для скачивания:

Скачать видео mp4

-

Информация по загрузке:

![Как сжимаются изображения? [46 МБ ↘↘ 4,07 МБ] JPEG в деталях](https://ricktube.ru/thumbnail/Kv1Hiv3ox8I/mqdefault.jpg)

![The Keynote Presentation by Michael Rasmussen, at the G[P]RC Summit 2024](https://ricktube.ru/thumbnail/RZD9rtLWo14/mqdefault.jpg)