Value at Risk (VaR) Explained: Parametric Method in Excel

Автор: The Quant Professor

Загружено: 2025-04-29

Просмотров: 871

EXCEL Value at Risk (VaR) Using Parametric Modeling | Financial Risk Management Tutorial

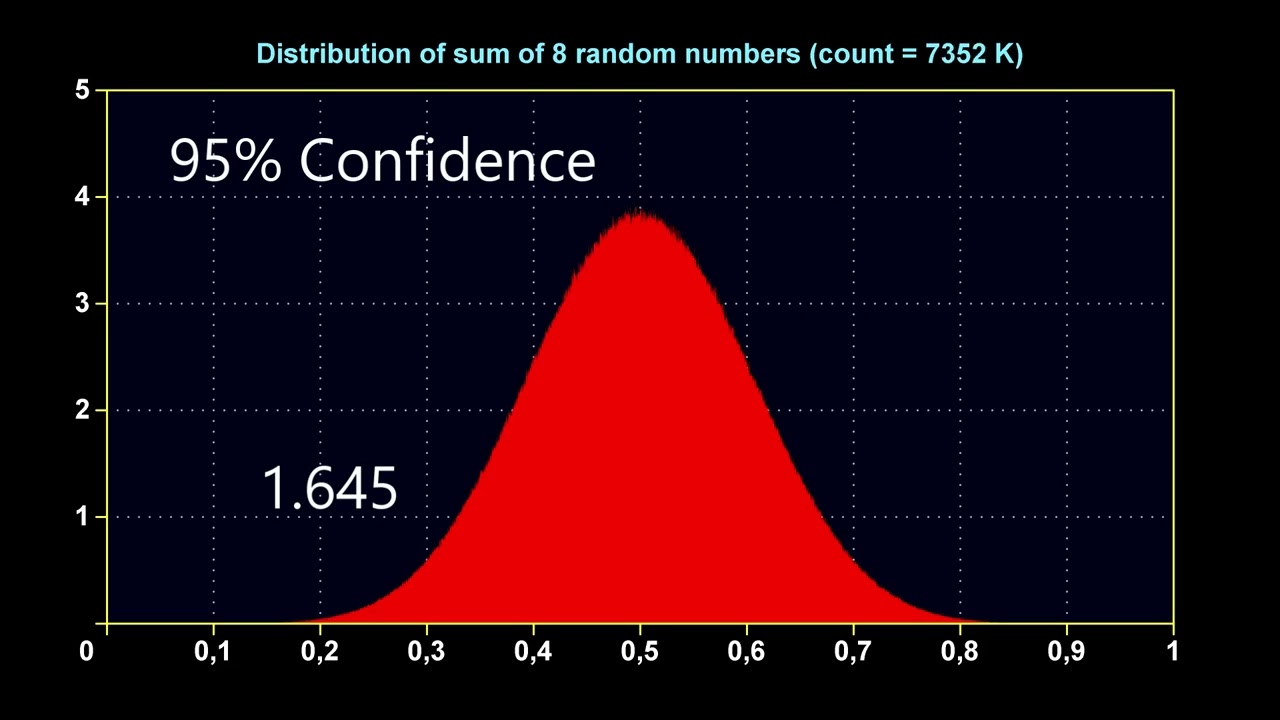

In this video, we deep dive into Value at Risk (VaR) — one of the most important tools in financial risk management — using the Parametric (Variance-Covariance) method. 🚀

You'll learn: ✅ What VaR actually measures (in real money terms, not just percentages)

✅ How to compute VaR step-by-step in Excel

✅ How portfolio diversification reduces risk — but why it can fail during crises

✅ Why the Parametric method is popular — and its major limitations when markets go haywire

✅ Practical tips if you're starting out in risk management, working in finance, or preparing for CFA exams or grad school courses

With practical Excel computations, and insider insights from experience training clients like the Central Bank, ADB, and major banks — this isn't just theory, it's what actually happens in professional risk management

⚠️ IMPORTANT: This video is computation-heavy. It's best to first review our lessons on statistics basics, matrices, and the correlation matrix if you're totally new to those concepts. Links are provided in our recommended playlist!

00:00 Intro

01:17 What is Value at Risk (VaR)?

03:26 What are ways to Compute VaR

04:24 Review of Computing Variance

05:26 Issue of Diversification

07:00 From Variance to VaR

09:20 Using the Correlation Matrix: The Why's and How's

12:16 Why use Parametric VaR

13:40 Problem with VaR

14:51 Key Practical Takeaways

#Finance #RiskManagement #ValueAtRisk #ExcelFinance #VaR #FinancialModeling #CFA #QuantitativeFinance #PortfolioRisk #ParametricVaR

Доступные форматы для скачивания:

Скачать видео mp4

-

Информация по загрузке: